BC Ferries: traffic, revenue, net earnings and expenditures are all up, however the financial results for the fiscal year ended March 31, 2022 (fiscal 2022) are still lagging behind pre-pandemic levels.

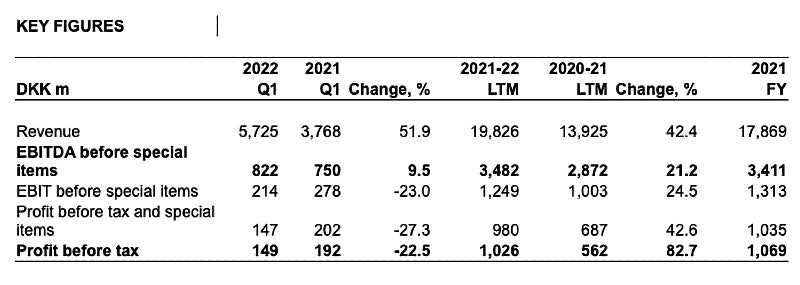

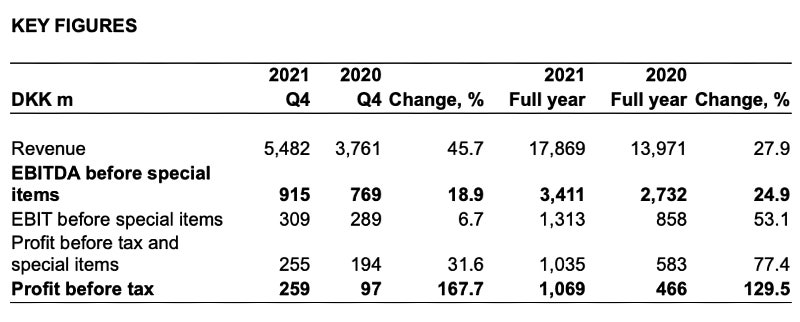

Key figures (full year, ending March 31, 2022)

+37% passengers (17.9 million) (but still 20% lower than pre-COVID fiscal 2019)

+26% vehicles (8.5 million) (but still 5% lower than pre-COVID fiscal 2019)

+12% Revenue $965.4 million

+11% Operating $868.0 million (increases in the number of sailings, staff required to provide more service, fuel and maintenance expenses.

BC Ferries experienced a net loss of $68.2 million prior to recognizing Safe Restart Funding. After recognizing $102.3 million of this federal-provincial funding, net earnings were $34.1 million, an increase of $13.1 million compared to the previous year, which included $186.0 million in Safe Restart Funding.

In December 2020, BC Ferries received $308 million through the Safe Restart Program, a federal-provincial initiative intended to help provinces and territories safely restart their economies. Assistance to the public transportation sector, including BC Ferries, has been a critical part of the BC Safe Restart Plan. Without this funding, BC Ferries would have recorded a total loss of $233.2 million over the past two years ($68.2 million in fiscal 2022 and $165.0 million in fiscal 2021).

The operating relief component of the Safe Restart Funding BC Ferries received has now been exhausted. The company does not foresee the need for any further COVID relief funding.