Stena Group

The Stena Group has in 2021 returned to profit after, for the first time in the Group’s eighty-year history, reported a negative result in 2020.

- A healthy balance sheet with an equity ratio of 36% as at 31 December 2021, compared to 35% as 31 December 2020.

- Strong liquidity position amounting to SEK 20.3 billion (19.9 billion).

- Total income amounted to SEK 39.0 billion (33.3 billion).

- EBITDA amounted to SEK 7.1 billion (SEK 4.9 billion).

- EBITDA increased compared to previous year, mainly as a result of increased EBITDA for the segments Ferry Operation, Drilling Offshore and New Businesses.

- Profit before tax amounted to SEK 499 million (–4,858).

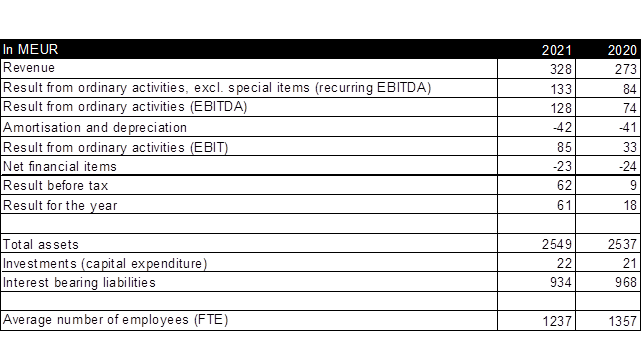

Stena Line

- Stena Line´s operational result increased compared to last year mainly due to strong freight volumes and cost reductions.

- Passenger and car volumes have improved as countries eased off Covid-19 travel restrictions.

- The operational EBITDA increase also includes extraordinary revenue of EUR 13.4 million in remuneration from UK Department for Transportation in order to guarantee transports into UK during the six months following Brexit.

Stena RoRo

Stena RoRo’s result increased in 2021 compared to 2020 because of a continued high utilisation rate and strong contract coverage of the fleet during the year, together with vessel sales as well as delivery and chartering out of newbuildings. The newbuilding programme from the CMI Jinling Weihai shipyard has continued during the year, which has resulted in three new contracts. In total 12 E-Flexer RoPax vessels have

now been ordered from the shipyard.