April 29, 2022

- Scandlines navigated market volatility and the impact of COVID-19 in 2021 and maintained margins thanks to a dedicated team effort and strict cost control.

- Scandlines solidified its position as a green front-runner with a long-term investment in a new emission-free freight ferry and ambitions of making the Puttgarden-Rødby route emission free by 2030 and realising its zero-emission vision by 2040.

- Traffic continued to fluctuate substantially in 2021 following political decisions to impose and lift travel restrictions in Scandlines’ markets in response to developments in COVID-19.

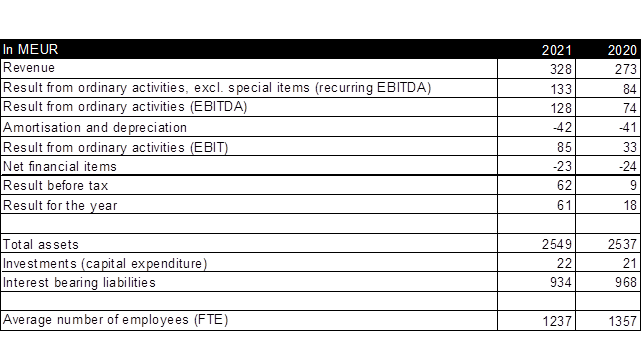

- Based on a gradual rebound in traffic volume compared to 2020, Scandlines grew revenue by 20% to EUR 328 million and maintained the EBITDA margin at 41% following tight cost control measures and efficiency enhancements.

- The two ferry routes generated revenue of EUR 260 million (2020: EUR 216 million) in 2021 as COVID-19 certificates were introduced, improving travel options, and government-imposed travel restrictions impacted fewer months of the year.

- Full-year traffic figures increased by double digits across all categories compared to 2020, but volumes remained significantly lower compared to 2019 except for the freight business, which continued to deliver consistent growth throughout the year, ensuring the strongest performance ever.

- The BorderShops saw higher activity in 2021 compared to 2020 and grew revenue by 19% to EUR 68 million.

- Profit from ordinary activities (recurring EBITDA) grew by 59% to EUR 133 million (2020: EUR 84 million) corresponding to a recurring EBITDA margin at a pre-COVID-19 level of 41% despite earnings remaining significantly lower than before the outbreak of the pandemic.

Outlook

- Car, passenger, and shopping traffic is expected to rebound strongly in the wake of COVID-19 with bus travel gradually returning to previous levels.

- The strong freight traffic performance is expected to continue throughout the year.

- Due to the continued high degree of uncertainty and very low visibility, management is currently not in a position to provide precise financial guidance for 2022.