Given the current economic and political instability, and “despite upheavals and thanks to both the diversity of our fleet and markets served and the efforts of employees onshore and at sea” Grimaldi Group registered record results in 2021.

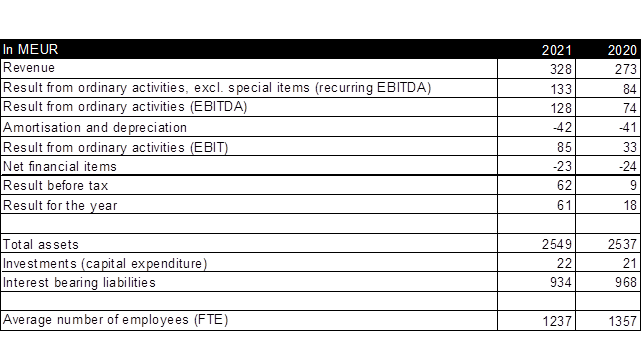

Consolidated turnover came in at EUR 3.46 billion, significantly up on the EUR 2.78 billion seen in 2020.

EBITDA came in at EUR 947 million, up from EUR 659 million the previous year, while equity increased to EUR 4.45 billion.

The Naples-based group informed that Trans-Atlantic operator ACL and the Grimaldi deep-sea services to West Africa and South America generated exceptionally good results amid high rates for the carriage of containers, in particular. But even the Grimaldi EuroMed services were successful, despite the microchip crisis and passenger transport limitations imposed by the pandemic.

Both Aegean operator Minoan Lines and Trasmed, the latter active on the Continental Spain-Balearic Islands routes, contributed to the 2021 EBITDA.

“Given, what is more, the very good result of the first quarter of this year, it is with positivity and confidence that we look to the future” Grimaldi also added. Specifying that by the end of 2024, the group will have taken delivery of another 14 newbuilds.