May 11, 2022

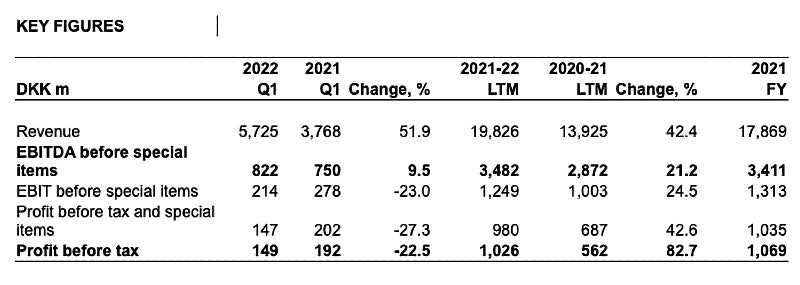

Group revenue increased 52% to DKK 5.7bn.

- Ferry Division’s revenue was increased by higher freight and passenger activity as well as a rise in bunker surcharge revenue.

- Logistics Division’s revenue was increased by the acquisition of HSF Logistics Group in September 2021 and ICT Logistics in January 2022 as well as higher activity and yield increases for the existing activities.

EBITDA increased 9% to DKK 822m.

- The total freight EBITDA for ferry and logistics activities before special items increased 10% to DKK 926m driven mainly by growth in the Mediterranean business unit, improved logistics performance, and the acquisition of HSF Logistics Group.

- The war in Ukraine reduced Baltic Sea’s freight volumes and the result.

- The total EBITDA for passenger activities in the Baltic Sea, Channel, and Passenger business units decreased 12% to DKK -104m.

- Earnings were reduced by the re-opening of Oslo-Frederikshavn-Copenhagen in a low season market environment with passenger numbers still recovering from Covid-19. This offset higher Channel earnings as all ferries have continuously operated in this market.

Outlook 2022

The revenue growth outlook is increased to around 30% compared to 2021 due to significantly higher revenue from oil surcharges as well as higher passenger revenue (previously 23-27%).

EBITDA before special items is unchanged DKK 3.9-4.4bn (2021: DKK 3.4bn).

The outlook is detailed on page 10 in the full report.