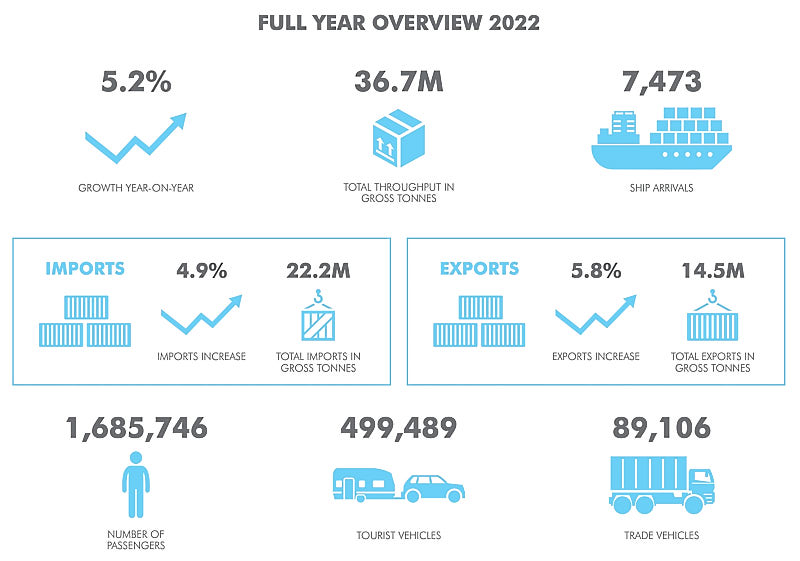

Belfast Harbour reported robust financial results for 2022, with annual turnover and profits in line with expectations, despite a challenging global trading environment.

Belfast Harbour reported turnover of £77.2m for 2022, up 5% on its figures for 2021, and underlying pre-tax profits of £34.3m, up 1% on the previous year.

Despite the climate of global uncertainty and external challenges sparked by the war in Ukraine, port trade dropped only slightly on the record levels recorded in 2021. Total tonnage through Belfast Harbour was reported at 24.5m tonnes, representing the second highest levels in its history, and a slight easing back of 4.3% from the record levels of 2021.

RoRo freight on Stena Line performed strongly, recording 600,000 freight units during the year, and matching the record performance delivered in 2021.

The volume of ferry passengers travelling through the Port increased by 22% year on year to almost 1.8 million people, with routes benefitting from the full easing of Covid-19 travel restrictions.

The number of passenger cars reached a record high of 462,000, increasing by 12% from the year before, reflecting a continued interest in staycations and local holidays.