DFDS’ strategy and financial ambitions have been updated as the Win23 strategy period, 2018-2023, comes to an end.

- Organic growth focus to unlock value from expanded network.

- Green transition ambition of 6 green ferries on the water by 2030

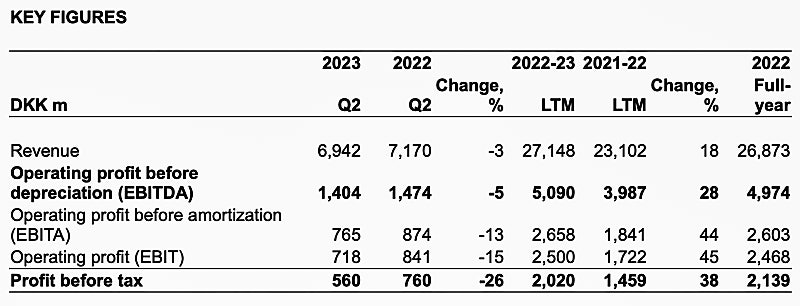

- Financial ambitions 2024-2026:

- Increase ROIC to above 10%

- Annual Adjusted Free Cash Flow of minimum DKK 1.5bn

- Financial leverage, NIBD/EBITDA, of 2.5x by 2026

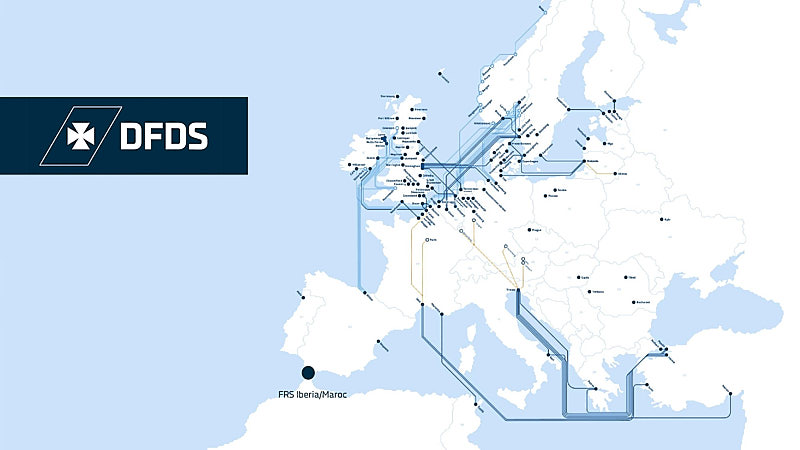

Towards 2030, focus will shift to unlocking the value of the expanded network by accelerating organic growth through increased exposure to high-growth markets, enhanced network capabilities, and increased relevance for freight customers requiring bundled transport and logistics solutions.

Five routes will be pursued to unlock the value of the expanded network and reach financial targets:

- Protect & Grow Profits – Organic growth focus driven by expanded product range and bundling of products to meet customer demand. Benefit from broader geographical network and access to high-growth markets. Enhance competitive cost base and capacity utilisation focus.

- Standardise to Simplify – Standardise operating procedures across our network to reduce complexity, enable growth and faster response to market developments. Reduce cost to serve through higher operating efficiency.

- Digitise to Transform – Further develop and grow self-service customer options. Provide more transparency and green data to enable flow optimisations. . Automate port terminal operations, deploy AI to enhance planning and prediction capabilities for sea and land transport. Future-proof tech platform to adopt new technologies faster and offer easier connectivity.

- Moving to Green – Achieve short-term climate plan targets through the Every Minute Counts ferry scheduling program and technical upgrades. Electrify port terminal and warehouse operations. Decarbonise trucking by switching to biofuel and battery driven trucks. Prepare green ferry newbuilding program and continue to develop partnerships to increase supply of green fuels.

- Be a Great Place to Work – Safety First program rollout. Adapt to new expectations among employees and provide engaging leadership. Promote diversity, equity, and inclusion among managers as well as office and non-office colleagues.

Six planned newbuildings:

- The 2030 target of a 45% reduction in ferry emission intensity for the existing fleet is unchanged. This includes the ambition to have six green ferries in operation by the end of 2030. The baseline for the emission reduction target is 2008.

- The ambition to become a net zero company by 2050 is unchanged.