“We have raised our outlook as we continued to deliver strong operational performance in Q2, and despite headwind in some regions, we achieved a result that was better than expected.”

Torben Carlsen, CEO DFDS

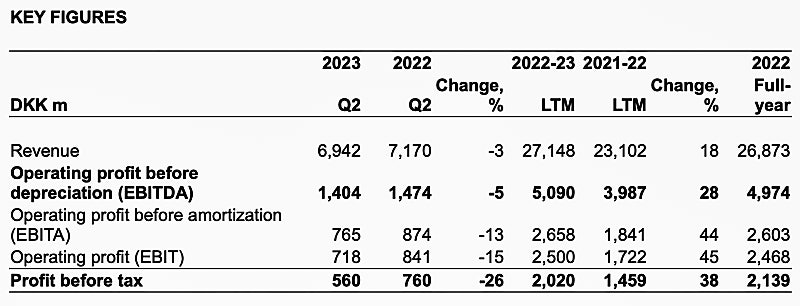

- Q2 revenue decreased 3.2% to DKK 6.9bn but increased 2.5% adjusted for bunker surcharges, driven by higher passenger and logistics revenue.

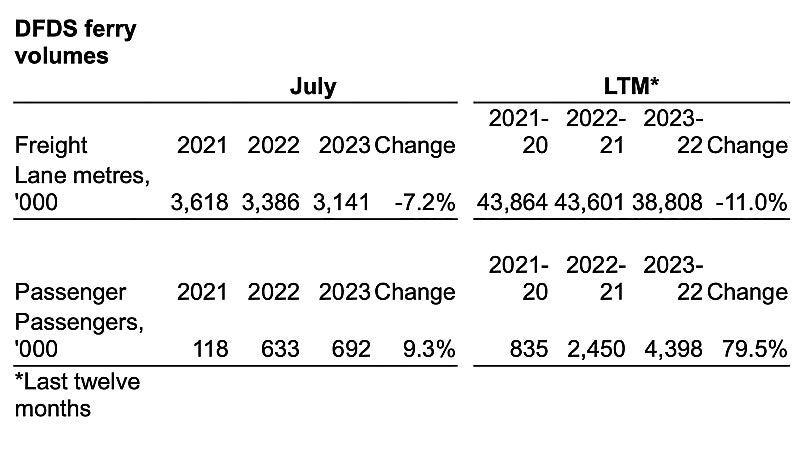

- Freight ferry revenue was below last year as lower volumes were partly offset by higher rates.

- Q2 EBITDA decreased 5% to DKK 1,404m.

- The freight ferry EBITDA of DKK 754m was 20% lower than last year as Q2 2022 earnings were boosted by elevated Channel earnings and exceptionally high levels of oil price spreads, that have now normalised. Moreover, Q2 2023 volumes were lower than last year.

- The Q2 passenger EBITDA increased 28% to DKK 350m as results were improved across the route network.

- Logistics Division’s EBITDA increased 26% to DKK 345m driven by acquisitions.

For the first half-year (H1), revenue increased 2% to DKK 13.3bn compared to the same period last year and H1 EBITDA increased 5% to DKK 2,413m. EBITDA was DKK 5,090m for the last twelve months (LTM, 2022-23).

Outlook 2023

The EBITDA outlook is raised to DKK 4.8-5.2bn (previously DKK 4.5-5.0bn) following better than expected H1 financial performance. Revenue is overall still expected to remain at the same level as 2022.

The outlook is detailed on page 9 in the full report.