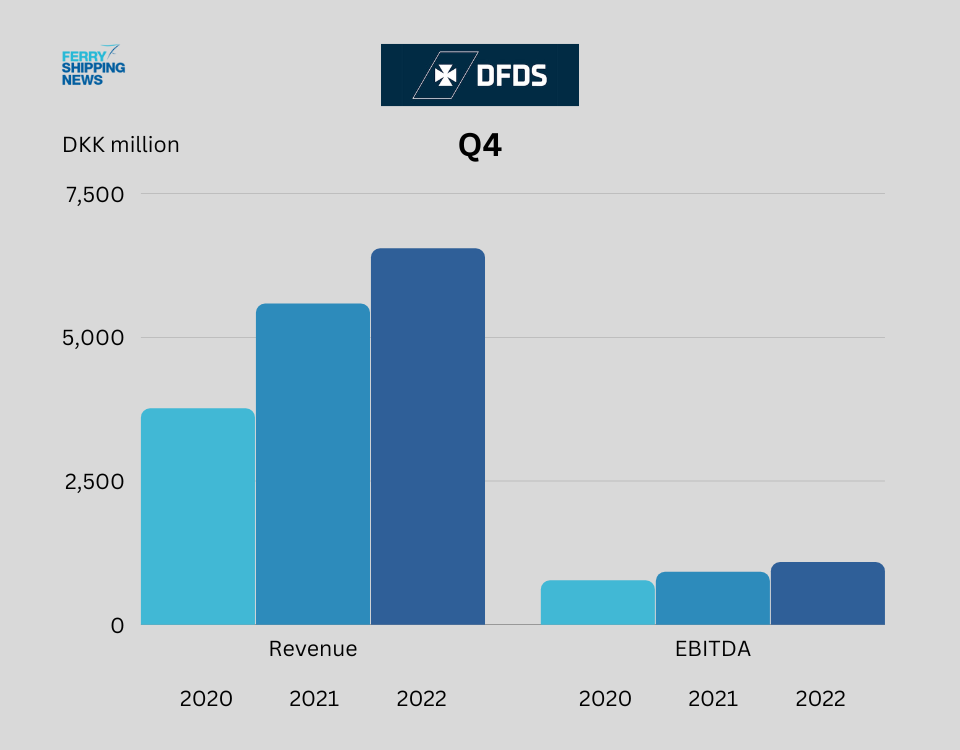

- Q4 revenue increased 17% to DKK 6.5bn driven by the continued recovery in passenger numbers and spending, as well as price increases for freight services to cover rising energy and other costs.

- Q4 EBITDA before special items increased 18% to DKK 1,084m.

- The EBITDA for freight ferry and logistics activities increased 5% to DKK 987m driven by higher logistics earnings as the freight ferry result was at the same level as 2021.

- The Q4 EBITDA for passenger activities in the Channel, Baltic Sea, and Passenger business units increased to DKK 97m from DKK -20m in 2021.

- The Q4 passenger EBITDA was 66% above 2019, the latest pre-Covid-19 year.

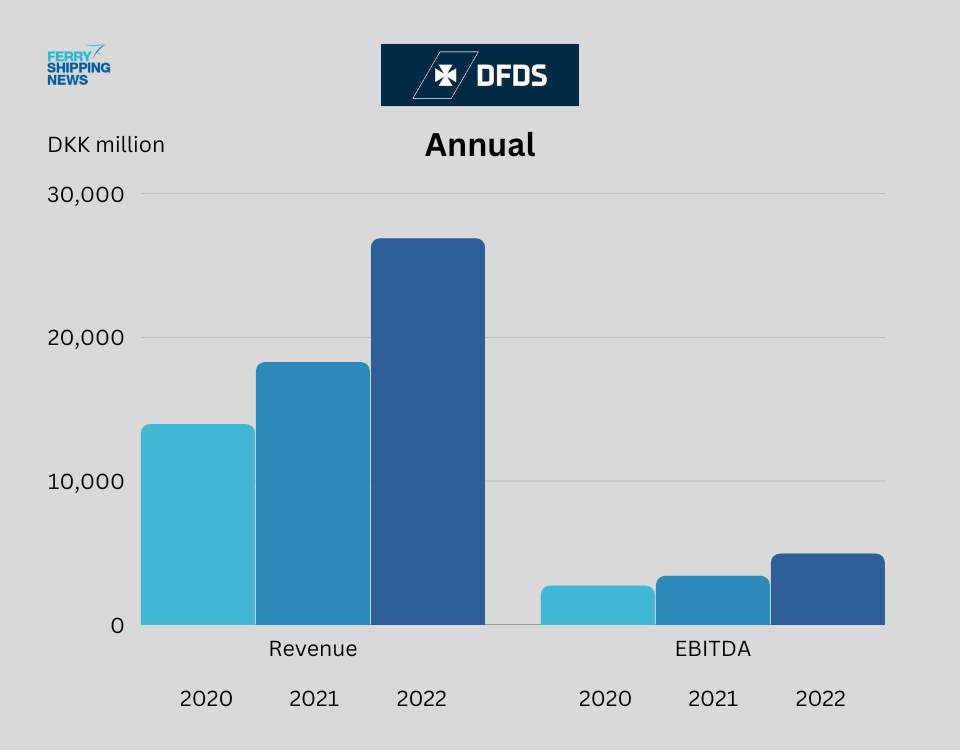

- For the full-year, EBITDA before special items increased DKK 1,544m or 45% to DKK 4,955m as the freight ferry and logistics result increased DKK 588m and the passenger result increased DKK 955m.

Outlook 2023

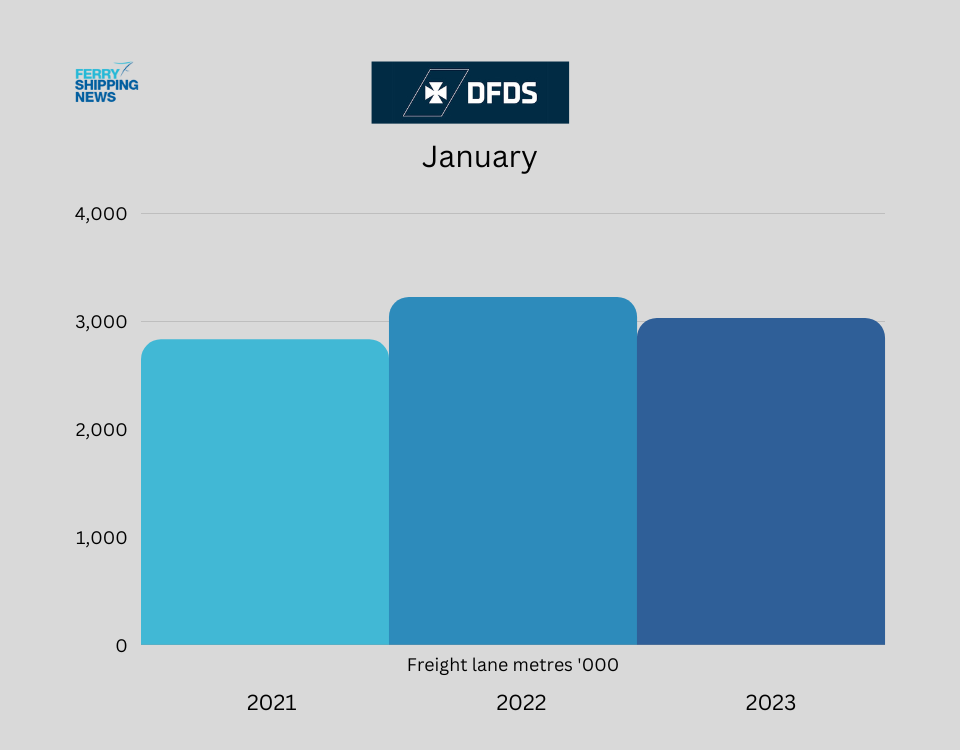

The outlook for EBITDA of DKK 4.5-5.0bn before special items includes continued growth but also assumes a European economic slowdown, negative impacts from the war in Ukraine, and overcapacity on the Channel. Revenue is therefore overall expected to remain at the same level as 2022.

Click here for a detailed outlook on page 10 in the full report

https://www.dfds.com/en/about/investors/reports-and-presentations/q4-report-2022

“2022 turned out to be the best year financially in DFDS history” Torben Carlsen, CEO