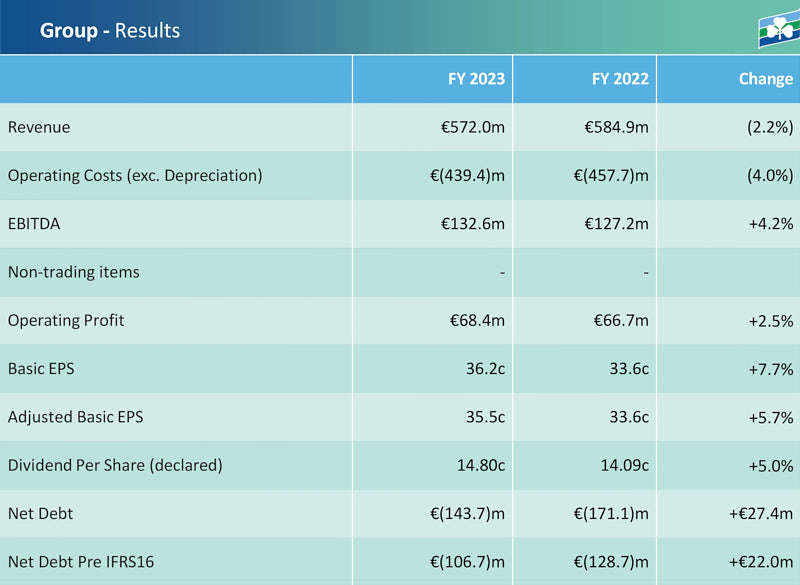

In 2023, Color Line reported the best earnings in its history, powered by high demand, stable production, and increasingly more cost-effective operations. This provides a solid point of departure for further commercial development and the green transition in the coming years.

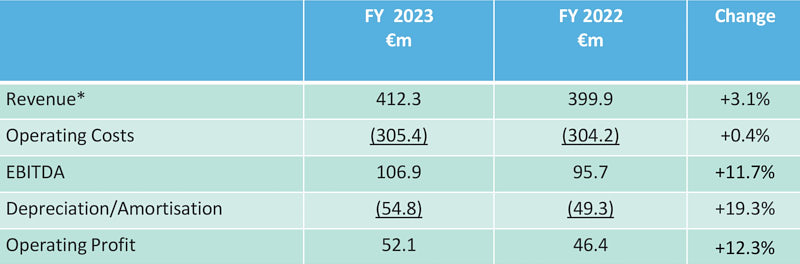

+EBITDA NOK 1.4 billion (NOK 1.2 billion in 2022)

+EBIT NOK 819 million (NOK 598 million in 2022)

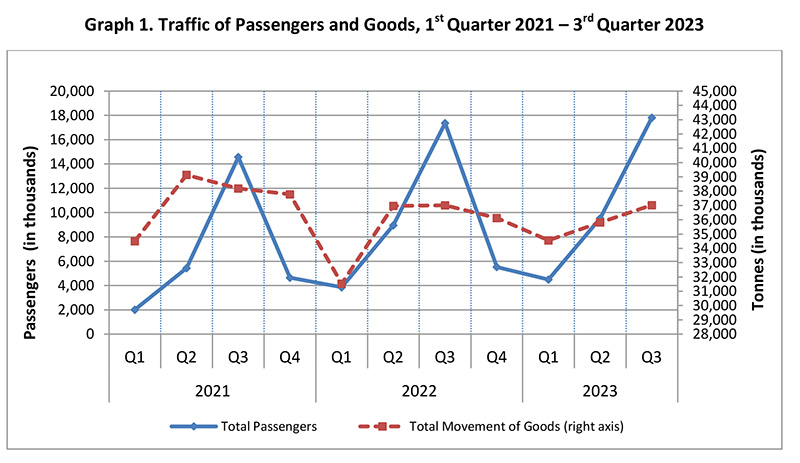

3.5 million pax (3.6)

180k freight units (190k)

In 2023, Color Line sailed with a fleet consisting of five ships of four international routes between Norway, Denmark, Sweden and Germany, after selling RoPax Color Viking and RoRo Color Carrier towards the end of 2022.

Outlook and focus:

- Green transition, including adapting operations to the phasing in of the EU ETS.

- Further developing its digital systems and capabilities

- Increased cyber security through cloud-based solutions

- Color Line is experiencing good demand in 2024, and expects a high season in line with 2023.

“In the coming years, the maritime sector will go through both the green shift and the digital transformation. However, Norwegian shipping is experiencing a gradual weakening of its framework conditions, which challenges the industry’s ability to adapt,” says CEO Trond Kleivdal.

Click on image below for report