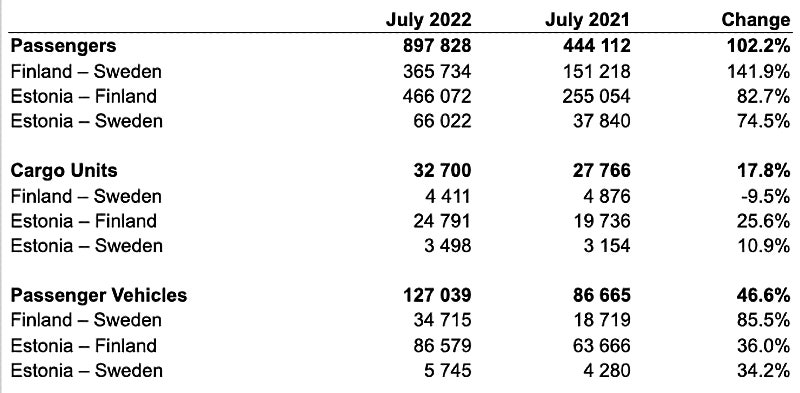

+102.2% passengers = 897,828 (compared to 1,238,871 in July 2019)

+17.8% cargo units = 32,700 (compared to 29,967 in July 2019)

+46.6% passenger vehicles = 127,039 (compared to 155,297 in July 2019)

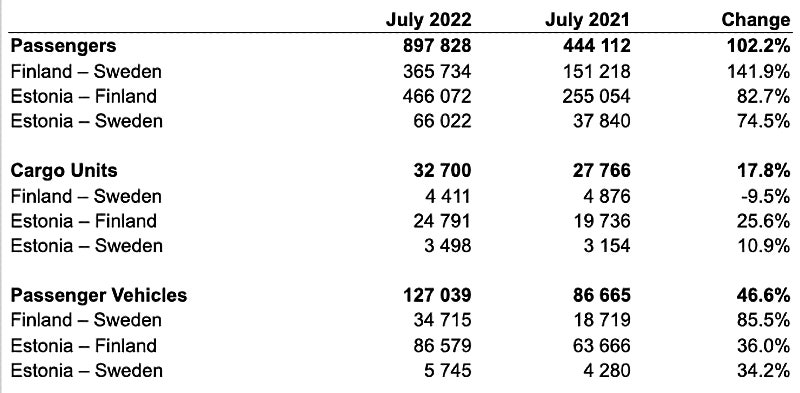

+102.2% passengers = 897,828 (compared to 1,238,871 in July 2019)

+17.8% cargo units = 32,700 (compared to 29,967 in July 2019)

+46.6% passenger vehicles = 127,039 (compared to 155,297 in July 2019)

The three Aero Highspeed Catamarans, built at Brødrene Aa shipyard, commenced on 8/8 their itineraries to the Saronic islands, offering up to 17 daily connections of the port of Piraeus with Aegina, Agistri, Poros, Hydra, Spetses, Ermioni and Porto Heli, in replacement of existing Group capacity in the market.

A replacement ferry for HOLIDAY ISLAND could carry passengers between Prince Edward Island and Nova Scotia by mid-August. HOLIDAY ISLAND suffered an engine room fire in July (see video).

SAAREMAA 1 left Trois-Rivières, Quebec, and will be tested in Caribou, Nova Scotia, Northumberland Ferries Ltd said. in a press release.

The evaluation is expected to take up to 10 days. If “everything fits,” it should arrive at Wood Islands shortly thereafter, PEI MP Lawrence MacAulay said.

CapMan Infra and CBRE Investment Management (CBRE IM), which each acquired a 50% stake in Norled AS in 2019, have now entered into an agreement for CBRE IM to acquire the entire stake managed by CapMan.

The exit is the first from the CapMan Nordic Infrastructure I fund.

CBRE IM is making the investment on behalf of a fund it sponsors as well as some of its separately managed accounts.

Norled’s current management team, led by CEO Heidi Wolden, will continue to run the day-to-day operations.

The departure of Tallink Silja’s ferry GALAXY (see this news here) from Turku could leave a gap of millions in the port’s income if it turns out to be permanent, estimates Turku Satama Oy CEO Erik Söderholm.

Following a successful trial, the Xiplink™ solution is now being used on two Irish Ferries vessels, W.B. YEATS and ULYSSES.

From the user perspective, the biggest benefit of the new Xiplink™ service is the substantially improved quality of experience enjoyed when accessing the internet.

From the perspective of Irish Ferries, it also offers QoS data management, thus affording the most important connections the highest priority throughout.

Brian Short, Information Security Manager at Irish Continental Group, said “Managing the bandwidth demands of multiple data and voice services has been a challenge. The traffic management and bandwidth optimisation features offered by Xiplink have been instrumental in enhancing the onboard experience for our customers, while also protecting revenue-generating services. Our partnerships with Voyager IP and Telenor have been vital to the success of this project, and we look forward to working with them to further develop our use of Xiplink.”

In an interview, Andrzej Madejski, president of Polska Żegluga Bałtycka (Polferries), said the following:

Optimistic is the outcome for the Hellenic Coastal Shipping according to the recent XRTC 21st annual ferry report 2022 which was published under the title: “Hellenic Coastal Shipping 2022: In a new Cycle of Development and Opportunities”.

The main points of the report are the following:

About ANEK LINES, the report says the following (p.28):

“ANEK LINES has been forced to reclassify its long-term liabilities into short-term liabilities as of 31.12.2018, since it failed to service its loan and based on the relevant contracts, the non-service of the loan obligations constitutes non-compliance with the terms, which entails the obligation of the company for full repayment of the loans.

As a result, short-term bank liabilities on 31.12.2021 amounted to 260.1 million euros compared to 252.9 million euros on 31.12.2020 and are increased by the outstanding interest of the financial year 2021.

In case of completion of the agreement between Piraeus and Alpha Bank and the creditors of ANEK on the extent of the impairment of its loan obligations, ANEK will be saved.

The plan includes the purchase of Alpha Bank’s loans to ANEK by Piraeus, which will then, together with other creditors, refinance the remaining impaired loans and transfer them to the newly enlarged Attica. The agreement under discussion provides for a significant reduction in bank lending, up to 150 million euros, and ensuring that suppliers are paid in full.”