“The Swedish investor Jakob Johansson has been Viking Line’s largest individual owner since 2019. Now he is proposed to take over the chairman’s baton from the Åland shipowner Ben Lundqvist,” writes Swedish business newspaper Dagens Industri (paywalled).

- In addition to boosting capacity on Finnlines’ own Zeebrugge – Rosslare route, FINNPULP is also to be chartered to P&O Ferries for one roundtrip per week. The vessel will depart Zeebrugge on Tuesdays and Teesport on Wednesdays from 28 February. The ferry companies have an existing cooperation, P&O Ferries providing stevedoring and ship handling for Finnlines’ Rosslare service at the Belgian port.

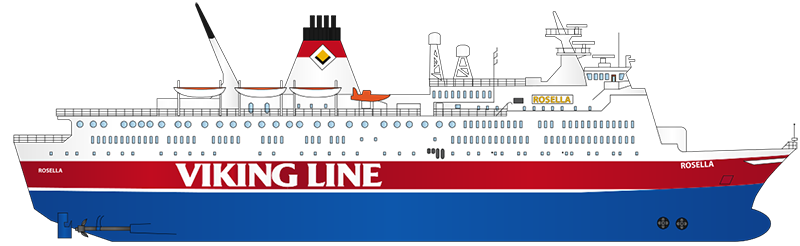

- Viking Line has announced that 13 March to 25 June, CINDERELLA will call at Kapellskär on her morning departure from Mariehamn to Stockholm. The sailing is a result of the sale of the ROSELLA and the loss of her sailings from Åland to Kapellskär.

- Björn Blomqvist, CEO of Rederi Ab Eckerö Group, has revealed that there has been recent interest in the sale or charter of their idle cruise vessel BIRKA STOCKHOLM. The ship has been laid up since the Covid pandemic arrived in March 2020. With interest from Europe and Southeast Asia there have also been enquires for using her as an accommodation vessel.

- From 1 March, Brittany Ferries will switch from Pound Sterling to Euro as the base currency onboard. Sterling will still be accepted onboard at the daily exchange rate but all products and services will have prices displayed as Euro. Full details of the change can be found here.

- Molslinjen has been given permission to replace the MAX MOLS with the EXPRESS 1 when the newbuild EXPRESS 5 is delivered as the main Bornholm fast ferry. Due to the subsidised service, the decision required approval of the Danish Ministry of Transport. The capacity of EXPRESS 1 up to that of the MAX MOLS will be sold within the contract but the additional part is to be sold commercially at Bornholmslinjen’s own risk. This arrangement will initially be for one year.

- Molslinjen’s fast ferries on the Kattegat are now registered with the Too Good To Go food waste scheme. This means that ferry passengers on the last departures of the day to Aarhus have the opportunity to buy food to take home from the ferries’ catering outlets. The scheme attempts to reduce food waste. A bag of food purchased on the app costs DKK 39 and can contain items such as croissants, sandwiches or salads.

January– December 2022 (compared to January–December 2021)

- Sales amounted to EUR 494.7 M (EUR 258.2 M).

- Other operating revenue was EUR 24.1 M (EUR 46.8 M).

- Operating income totalled EUR 38.3 M (EUR 32.1 M).

- Net financial items were EUR -10.0 M (EUR -3.8 M).

- Income before taxes totalled EUR 28.3 M (EUR 28.3 M).

- Income after taxes totalled EUR 23.0 M (EUR 24.4 M).

Outlook for the financial year 2023

- Significant uncertainty continues due to the geopolitical situation. This is impacting directly on energy prices, inflation, interest rates and currencies and indirectly in terms of propensity to travel, demand, consumption patterns and costs.

- AMORELLA was sold in Autumn 2022, and at the end of the year an agreement was reached on the sale of ROSELLA for delivery in January 2023. The company does not foresee any further vessel sales in 2023.

- Provided that energy prices remain at their current level and taking into account that capital gains are expected to be lower than in 2022, the Board of Directors estimates that income before taxes will be somewhat lower than in 2022..

Jan Hanses, CEO of Viking Line said;

“Our results for 2022 should be described as good. The new financial year 2023 will be both demanding and engaging. We are closely following economic developments and adapting operations to meet the challenges we face, particularly concerning the new environmental norms. Meanwhile, we are optimistic about the future.”

Fourth Quarter Results 2022 (compared to Fourth Quarter 2021)

- Sales amounted to EUR 124.5 M (EUR 89.3 M).

- Other operating revenue was EUR 15.2 M (EUR 2.2 M).

- Operating income totalled EUR 19.4 M (EUR 1.6 M).

- Net financial items were EUR -2.5 M (EUR -0.4 M).

- Income before taxes amounted to EUR 16.9 M (EUR 1.2 M).

- Income after taxes totalled EUR 13.6 M (EUR 1.7 M).

During the latter part of Q4, the company’s passenger operations have

performed better than expected, which has improved the company’s results.

In the previous outlook, uncertainty factors such as the geopolitical situation and its impact on energy prices, inflation, interest rates and currencies have been cited as having a negative impact on the result.

These have not had as strong an impact as previously feared.

Viking Line Abp assesses that the operating result for 2022 will be slightly better than 2021

and that the result before taxes is expected to be on par with 2021.

The previous view was that operating income was expected to be somewhat worse than for 2021.

Year 2022, like the previous year, continued to be exceptional for the whole world, as well as for Viking Line:

Negative: pandemic + Ukraine + sky-high fuel prices + market uncertainty.

Positive: a renewed demand to travel, especially locally.

Fleet changes:

- AMORELLA and ROSELLA sold.

- VIKING GLORY entered service in March. The ship has been very popular and will reach the 1 million passenger milestone after less than a year in traffic.

Traffic in 2022:

+114% Total passengers 4,945,564 (2,315,137)

+116% Turku – Åland – Stockholm 1,955,988 (904,321). Viking Line’s market share was 64 %.

+236% Route Helsinki – Åland – Stockholm (GABRIELLA) 515,445 (153,183) passengers.

+102% Route Stockholm – Mariehamn (cruise with VIKING CINDERELLA) 517,354 (256,344)

+33% Route Mariehamn – Kapellskär (ROSELLA) 464,375 (348,209)

+116% Route Helsinki – Tallinn (VIKING XPRS) 1,266,642 (586,354)

+42% Total passenger cars 630,651 (442,484)

-9% Total freight units 117,777 (129,278)

Photographer: Joonas Kortelainen

Viking Line has agreed to sell ROSELLA to Greek Aegean Sealines Maritime Co.

The workhorse has served in Viking Line’s fleet since 1980.

ROSELLA will sail under a Greek flag and serve the Aegean Sea.

Viking Line has worked with great focus to modernize its fleet and is evaluating alternative solutions for its short-distance routes between Sweden and Åland.

The sale price is EUR 11,250,000 and will generate an accounting profit of about EUR 8,600,000 during the first quarter of 2023.

The vessel will end its service on January 8, 2023. Delivery will take place during the latter half of January 2023.

Aegean Sea Lines was founded in 2005 as the Aegean Speed Lines operating mainly high speed craft on the Piraeus – Western Cyclades line. In 2006, its shareholders changed and in 2009 they brought the successful Italian build sisters HSC SPEEDRUNNER IΙΙ, SPEEDRUNNER IV on the above line.

In 2016, Aegean Speed Lines sold SPEEDRUNNER IV due to the financial crisis that hit the Hellenic Coastal Shipping as well, while in April 2022 sold its only vessel SPEEDRUNNER III to Seajets but leaving a promise that it will come back!

With the today’s announcement the Aegean Sea Lines makes a dynamic come back on the line that made her great.

Viking Line Abp had decided to register its passenger ship Viking XPRS in the Finnish Register of Ships. The vessel, which began service in 2008, has been registered in Estonia since 2014.

The decision to register the vessel in Finland was made in order to make it easier to recruit staff and enable the company to administer all of its staff without any intermediaries. The goal is to have the reflagging work completed during the first quarter of 2023.

Viking Line will begin the process of filling all the positions on board Viking XPRS under the Finnish flag with a few exceptions. Employees currently working on board the vessel (about 175 people) and employees from the company’s other vessels that sail under a Finnish flag can submit applications.

November 18, 2022 – Viking Line Abp acquired 17.1 % of the shares in Rederiaktiebolaget Eckerö for EUR 30/share, a total of EUR 10,269,300.

Viking Line received information that a larger stake in Rederiaktiebolaget Eckerö was for sale. To ensure that the share ownership stays on Åland, Viking Line chose to acquire the post.

Rederiaktiebolaget Eckerö is the parent company of the Eckerö Group, which consists of four business areas:

- Eckerö Linjen operates car ferry traffic between Eckerö and Grisslehamn with ropax ECKERÖ.

- Eckerö Line operates car ferry traffic between Helsinki and Tallinn, with FINLANDIA and FINBO CARGO.

- Eckerö Shipping owns roro TRANSPORTER (on charter to DFDS) and inactive passenger vessel BIRKA STOCKHOLM.

- Williams Buss has high-class buses for public transport and tourism travel.

The Group’s head office is located in Mariehamn.

During the year 2021, the annual turnover amounted to approx. 123 million euros and the group transported approx. 1.4 million passengers and approx. 166,000 freight units on its own routes.

JANUARY-SEPTEMBER 2022

- Sales amounted to EUR 370.2 M (169.0 M)

- Other operating revenue was EUR 8.8 M (44.6 M)

- Operating income totalled EUR 18.9 M (30.5 M)

- Net financial items were EUR -7.5 M (-3.4 M)

- Income before taxes amounted to EUR 11.4 M (27.1 M)

- Income after taxes totalled EUR 9.5 M (22.7 M)

- The outlook for the 2022 financial year is unchanged compared to the Half-Year Report as of June 30, 2022, which means operating income is expected to be somewhat worse than for 2021.

THIRD QUARTER 2022

- Sales amounted to EUR 170.4 M (EUR 97.5 M)

- Other operating revenue was EUR 0.5 M (EUR 11.0 M)

- Operating income totalled EUR 26.9 M (EUR 26.0 M)

- Net financial items were EUR -2.8 M (EUR -1.0 M)

- Income before taxes amounted to EUR 24.1 M (EUR 24.9 M)

- Income after taxes totalled EUR 19.3 M (EUR 20.0 M).

Viking Line’s AMORELLA was handed over to Corsica Ferries SAS on 13 October 2022.

The name of the vessel will be MEGA VICTORIA after reflagging.