Q1 2024

- Revenue up 11% to DKK 7.0bn

- EBIT reduced 45% to DKK 200m

- Adjusted free cash flow of DKK -327m

- CO2 ferry emission intensity lowered 3%

OUTLOOK 2024

- EBIT of DKK 2.0-2.4bn

- Revenue growth of 8-11%

- Adjusted free cash flow of around DKK 1.5bn

Torben Carlsen, CEO:

- 2024 is the first year of new strategy “Moving Together Towards 2030” focused on unlocking the value of DFDS’ expanded network through organic growth and transitioning to become a greener company.

- Ekol Logistics: transaction is expected to close in Q4 2024.

- FRS: the newly acquired ferry routes on the Strait of Gibraltar were off to a good start.

- High priority: improving earnings for activities that currently face market headwinds such as the Baltic Sea and Channel ferry networks as well parts of Cold Chain logistics activities.

- The short-term decarbonisation of ferry activities is on target, and in parallel DFDS is laying the groundwork to achieve its ambition of having six green ferries on the water by the end of 2030.

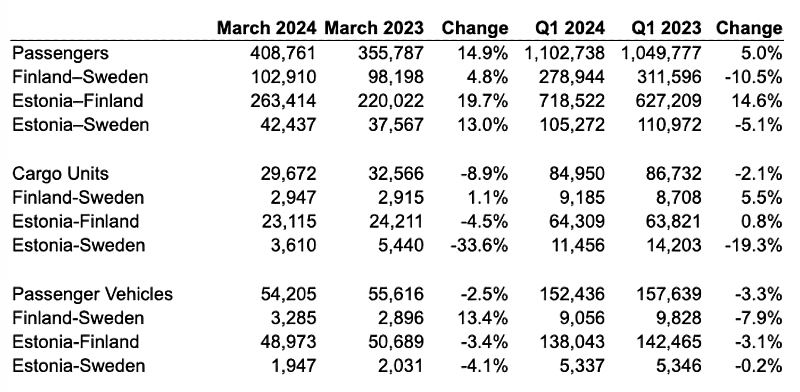

- Market environment remains mixed: a higher than expected pick-up in ferry volumes across most of the network in Q1 while land transport network mostly faced flat or lower volumes.

- Persistent overcapacity enhanced pricing pressure in certain market areas.

- “While we are on track to deliver on our outlook, we continue to focus on improving profit through operational efficiencies across our network in parallel with the execution of our strategy.”

Click on cover to read more