Up to half of all lorries bringing goods into Britain are returning to Europe empty as British companies put off resuming exports to the Continent to avoid getting caught by new customs regulations.

Connecting Ireland after Brexit

Ireland has ramped up direct shipping routes to mainland Europe since the end of the Brexit transition period. This has resulted in new routes and the addition of tonnage capacity.

Rather than giving the information in bits and pieces we want to keep an overall view on the market. That’s why we start with this weekly feature: a logbook of what’s happening.

This is a growing project. We start with the different events on the seabridge between the Republic of Ireland and the Continent. As from next week we’re also going to keep track of the landbridge connections.

Feedback is always welcome.

Click on the picture to access the logbook.

Irish Hauliers are Bypassing Welsh Ports to Avoid Brexit Bureaucracy

“On our European routes there’s a 500% increase in freight volume going through the port compared to last year,” says Glenn Carr, GM Rosslare Europort.

He believes this change in operations will not be temporary.

He said decisions by ferry companies and businesses who trade with the EU to re-direct freight, have been made based on market analysis.

Photo: Rosslare Europort

Source: BBC

Stena Line’s Newest Ship Debuts on Rosslare-Cherbourg instead of Belfast-Liverpool

Stena Line’s brand-new STENA EMBLA will make its Irish Sea debut on the Rosslare-Cherbourg service. Originally scheduled for service on the Belfast-Liverpool route, due to the current Brexit related shift for direct routes and increasing customer demand, Stena Line has decided to temporarily deploy her on Rosslare-Cherbourg.

The first sailing will be from Rosslare on 14 January 2021.

STENA EMBLA will make three weekly return trips between Rosslare and Cherbourg, which alongside the STENA FORETELLER will see Stena Line operate 12 crossing per week between Ireland and the Continent.

Ferry Shipping News understands that route vessel STENA HORIZON needs maintenance. If she will return on the route is so far unclear.

DFDS’ preliminary, unaudited EBITDA before special items was raised to DKK 2.73bn for 2020 by UK stockbuilding ahead of Brexit that was more extensive than expected. The outlook range was DKK 2.5-2.7bn.

DFDS December volume report: Freight up 28% boosted by stockbuilding ahead of brexit

- Freight lane metres (,000):

- December 3,594 (2,810) = +28%

- Full year 40,886 (41,280)= -1.0%

- Passenger (,000):

- December 78 (370)= -79.0%

- Full year 1,498 (5,116)= -70.7%

North Sea volumes were boosted by stockbuilding ahead of Brexit, especially on the routes between Netherlands and the UK but also between Sweden and the UK.

Volumes on the English Channel were likewise boosted by the stockbuilding.

Baltic Sea volumes were above 2019 adjusted for the closure of the Paldiski-Hanko route.

Mediterranean volumes were above 2019 driven by higher volumes on all main corridors.

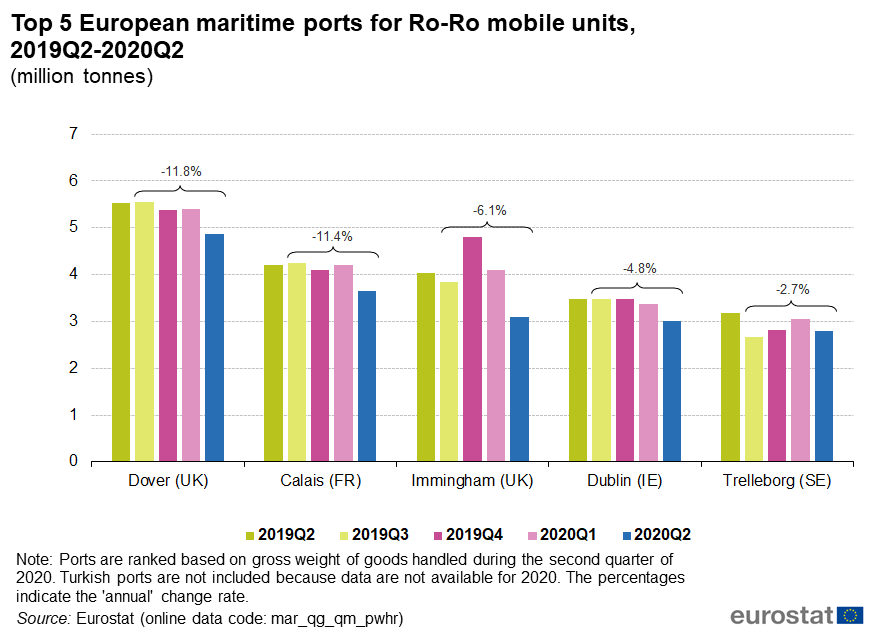

Dover remained the largest European roro port in Q2 of 2020.

On the other side of the Channel, the port of Calais was in the second place, followed by Immingham, Dublin and the Swedish port of Trelleborg, which enters the top 5 for first time.

The five ports recorded a substantial fall in Q2 compared to the same quarter of 2019; the largest observed for Immingham (-23.7 %), followed by Calais (-13.3 %), Dublin (-13.2 %), Dover and Trelleborg (both 12.1 %).

When looking at the overall annual change compared to the previous period, all five ports also registered a fall. The highest was observed for Dover (-11.8 %), followed by Calais (-11.4 %), Immingham (-6.1 %), Dublin (-4.8 %) and Trelleborg (-2.7 %).

CLdN is to step up preparations for the end of the Brexit transitional phase on 31st December 2020 by introducing additional capacity on its UK routes.

- Last week 25% extra capacity was added on both the Rotterdam – London and Rotterdam – Humberside routes.

- In addition, and from week 42, an extra vessel will be deployed and thus a third daily sailing will be added on the Zeebrugge – London route to serve the growing demand.

One of the reasons for the high demand is the fact that British companies are preparing for a no-deal end of the Brexit transition period by stockpiling essential goods.

News from our Sponsor Adonis: SeaDream Implements Adonis

After a lengthy selection and review process, SeaDream Yacht Club, the Norwegian cruise line is now installing Adonis’ market leading HR and payroll platform.

SeaDream is operating cruises in the western Norwegian fjords this summer (instead of the Mediterranean). This means that the ships are easily accessible and the implementation project will be completed much quicker.

“Even though we currently only have two ships in operation, there is an urgent requirement to migrate to a new personnel administration solution. The opportunities presented by Adonis’ Self-Service module are significant and the value of this aspect will only increase as we roll it out through the company. The efficiencies this will bring will enable us to make significant time and cost savings for years to come,” says Jannik Madsen, Director Maritime Personnel Manager at SeaDream’s head office in Oslo.

U.K. Revives Operation Brock

The Brexit could create chaos, especially in the Dover area (Channel ferries and Eurotunnel).

The UK Department for Transport decided to resurrect Operation Brock, a traffic management system designed to limit tailbacks.

Therefore, it started a consultation round about proposed legislative amendments for enforcing traffic management plans for outbound heavy commercial vehicles in Kent after the EU transition period.

This consultation closes at 11:59pm on 23 August 2020