Tallink Grupp’s 2022 Unaudited Financial Results reveal a profitable year.

- Full year profit of EUR 13.9 million (EUR 56.6 million net loss in 2021)

- Consolidated revenue of EUR 771.4 million (EUR 476.9 million in 2021)

- EBITDA of EUR 135.8 million (EUR 58.3 million in 2021)

- Investments of EUR 203.3 million. EUR 176.7 million related to the new shuttle vessel MYSTAR.

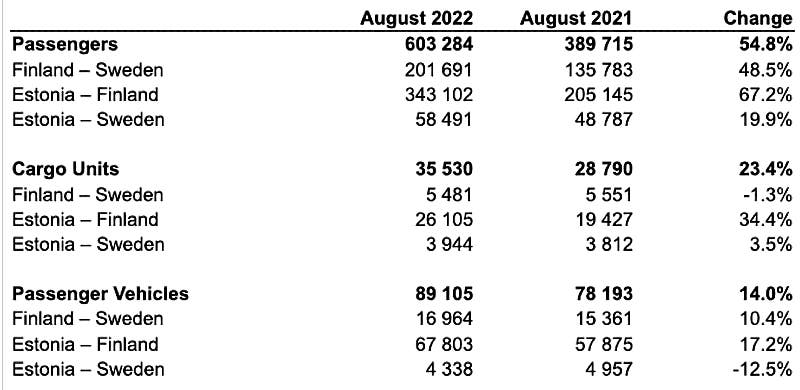

- 5 million Passengers (2.96 million in 2021).

- 409,769 Freight units (369,000 in 2021)

The 2022 results were impacted by firstly the remaining Covid Travel Restrictions in force at the start of the year and then, more significantly, by the Ukraine War and resultant business cost increases.

Two ships are on long-term charters (ATLANTIC VISION and ROMANTIKA) and four on short-term charters (ISABELLE, SILJA EUROPA, GALAXY and VICTORIA I)