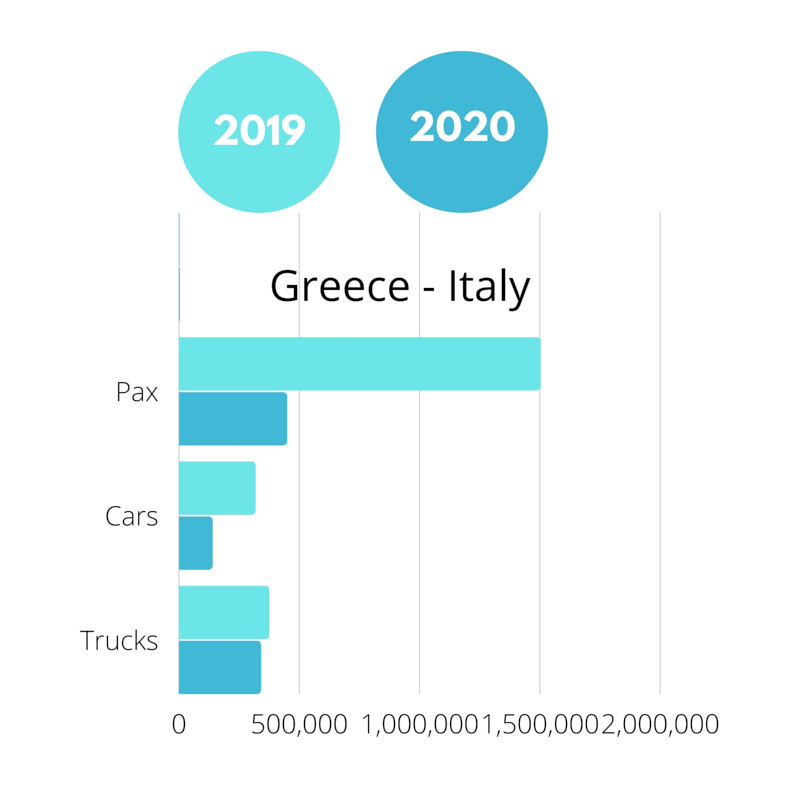

The last years were very tough for the ferry market, especially for the passenger sector. Although the freight market was not so much affected by the pandemic and started to recover earlier, the passenger traffic was more exposed to restrictions due to the Covid-19 pandemic.

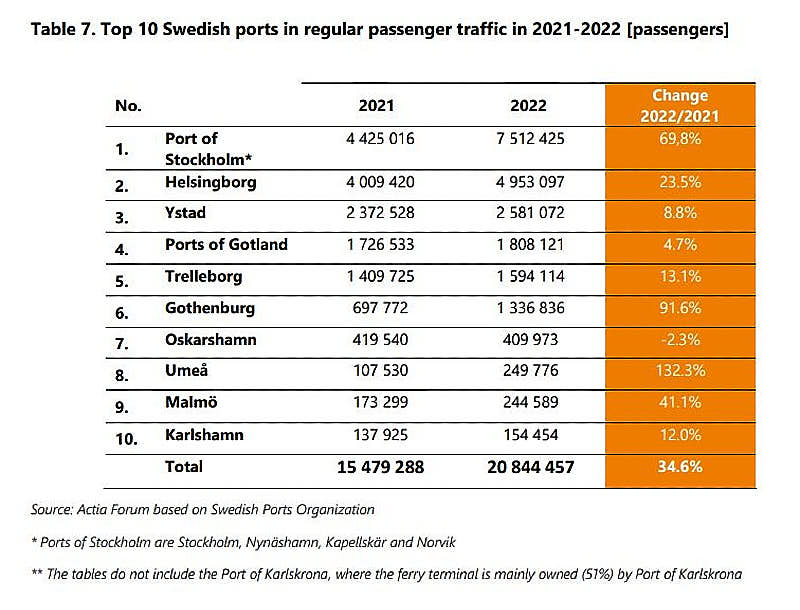

In 2022, total passenger traffic in Sweden amounted to nearly 21 million passengers, which indicates an increase by 35% in comparison with 2021 and 61% compared to 2020 figures.

The three biggest ports in terms of regular ferry passenger traffic are:

- Ports of Stockholm (7.5 million passengers in 2022, +69.8%). Especially, traffic to popular tourist destinations such as Åland Islands and Helsinki increased.

- Helsingborgs Hamn – Port of Helsingborg (4.9 million passengers in 2022, +23.5%). Due to stabilization of the pandemic, the commuters came back to their offices and started regular ferry crossings to Denmark.

- Port of Ystad (2.6 million passengers, +8.8%)

Increases were observed in the vast majority of Swedish ports.

Demand is expected to remain high, or even to increase.