Tallink Grupp reported an unaudited net loss of EUR 108.3 million for the 2020 financial year (net profit of EUR 49.7 million in 2019), resulting from travel restrictions, border closures and states of emergency due to the global COVID 19 pandemic.

Consolidated revenue amounted EUR 442.9 million (949.1 million)

EBITDA EUR 8.0 million (171.1 million)

Gross profit EUR -43.5 million

-62% passengers

-5.2% cargo units

-20% trips

Attempts to boost its operations by setting up various temporary routes during summer 2020 and by operating a number of special cruises where possible. These attempts were once again curbed in autumn 2020 by travel restrictions.

Investments EUR 100.1 million.

Mainly prepayment instalments for the new LNG-fuelled vessel MYSTAR (2022).

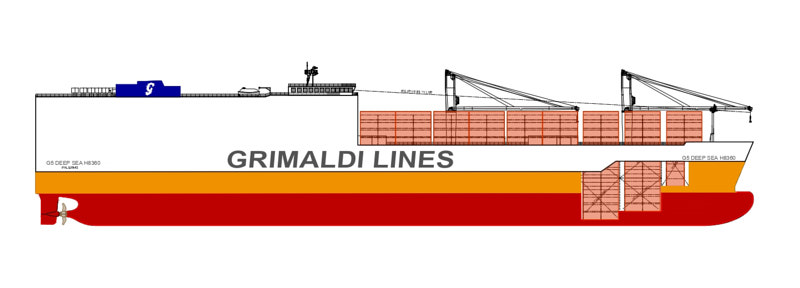

Also increasing the company’s cargo capacity by acquiring roro SAILOR.

The group ended the year with a total liquidity buffer of EUR 147.1 million (EUR 128.9 million in 2019).

Employee numbers: from 7240 at the end of 2019 to 4237 at the end of 2020.

Tallink Grupp’s CEO Paavo Nõgene: “As we wait for the COVID storm to pass and borders to reopen for travelling, we continue to develop business areas we feel will give us a strategic advantage going forward and enable us to spread risks, make preparations for offering our services again with an even stronger focus on safety and sustainability and get ready to provide safe and happy journeys and to reunite people around the Baltic sea after a year of separation.”