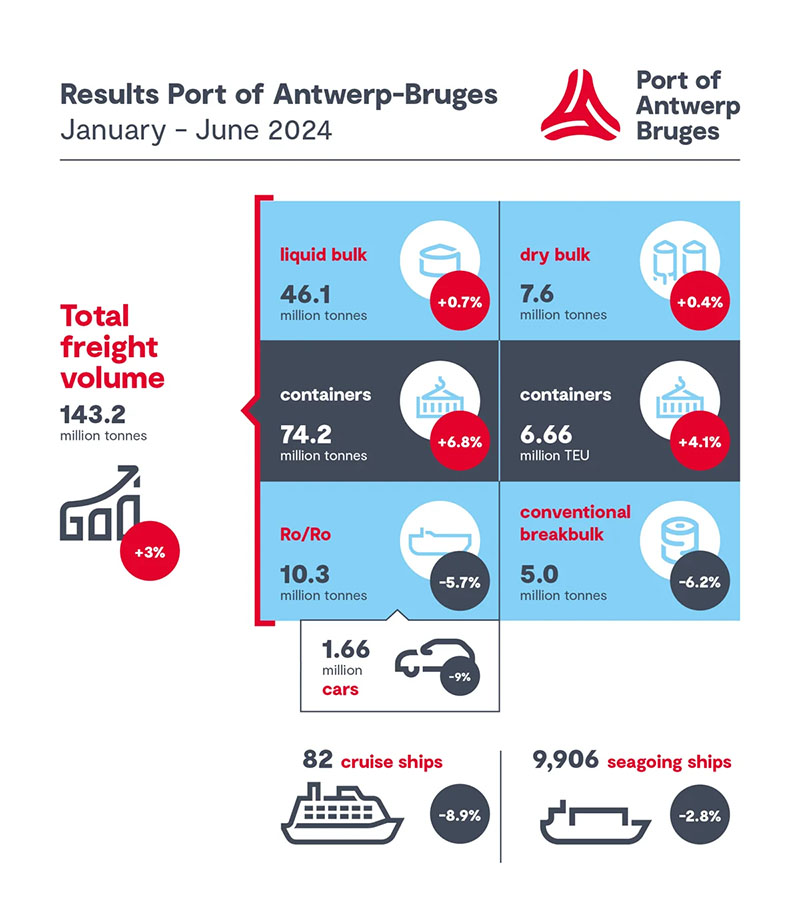

Positive trend in container throughput expands to other product groups

RoRo traffic dropped in the first half of 2024 by 5.7% – a minor improvement compared to the end of the last quarter.

The congestion at the RoRo terminals persists due to the altered business model of the car manufacturers stockpiling at the ports, decreased demand and delayed exports caused by sailing around the Cape of Good Hope. This resulted in a decrease in throughput for all transport materials by 13.2%. The lower throughput of second-hand cars in particular (-45.8%) contributed to this, followed by high & heavy (-22.7%), trucks (-17.6%) and new cars (-9%).

Throughput of unaccompanied cargo (excluding containers) carried on RoRo vessels, on the other hand, rose by 2.4%. The decline in throughput to and from the United Kingdom (-4.6%) was more than compensated by an increase in throughput to and from Spain and Portugal (+35%), Scandinavia (+18%) and Ireland (+1.4%).

For the complete results: Newsroom Port of Antwerp Bruges