Port of Antwerp-Bruges faced heavy geopolitical and operational pressure in 2025, including congestion, trade uncertainty and industrial action.

Key points:

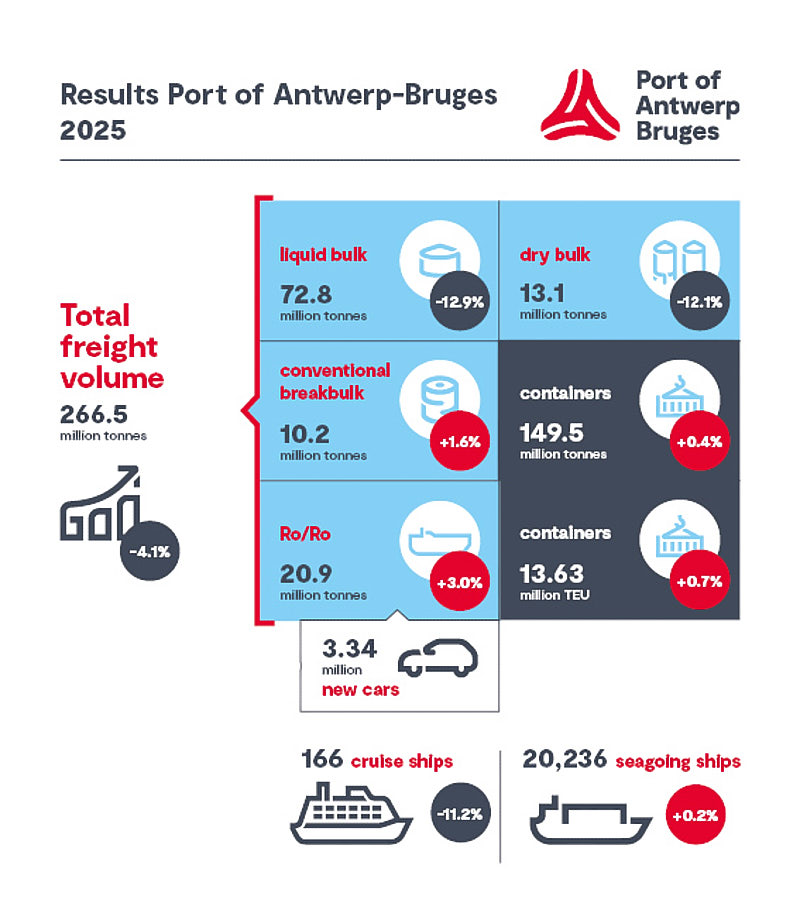

- Total maritime throughput: 266.5 million tonnes (-4.1%)

- Container throughput remained almost stable, with slight growth of 0.4% in tonnage and 0.7% in TEU.

- RoRo throughput: +3%, driven by growth in Trucks, Heavy equipment and Used cars

- Higher US tariffs reduced exports of iron, steel and cars

- Container imports from China rose by 3.8%, widening trade imbalances

- Around 25 days of industrial action caused an estimated loss of 2.4 million tonnes (~1%)

- Cruise calls fell to 166, carrying 466,089 passengers

RoRo was one of the few bright spots, confirming continued demand for rolling cargo flows despite a difficult year for European port logistics.

Source: POAB