Group Highlights

- Revenue: €309.9m (+8.5%).

- EBITDA: €54.9m (+10.5%).

- Operating profit: €24.6m (+41.4%).

- Profit before tax: €20.5m (+40.4%).

- Net debt: €224.1m (up from €162.2m at year-end 2024).

- Interim dividend: 5.37c per share (2024: 5.11c).

- Strong liquidity maintained despite €90.2m in capital expenditure.

- Investments: purchase of cruise ferry JAMES JOYCE and container vessel CT ENDEAVOR.

- All eight ferries now owned or under purchase obligation.

Irish Ferries (Ferries Division)

- Revenue: €206.0m (+4.3%).

- EBITDA: €40.0m (+7.0%).

- Operating profit: €14.1m (+48.4%).

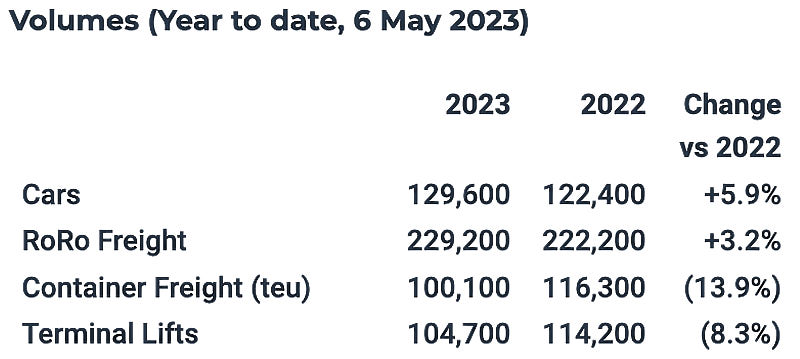

- Car volumes: 264,900 (-4.4%).

- Passenger volumes: 1.28m (-3.5%).

- RoRo freight volumes: 393,300 (+2.2%).

- Passenger revenue: €84.5m (+8.6%) despite fewer sailings.

- Freight revenue: €100.8m (+1.4%).

- Disruption from Holyhead Port closure in early 2025, partial recovery since January.

- Fleet developments:

- JAMES JOYCE purchased from Tallink, deployed on Dublin–Holyhead.

- ISLE OF INISHEER redeployed to Dublin–Cherbourg, enabling daily service with WB YEATS.

- OSCAR WILDE operating Dover–Calais since June 2024.

- Fuel & emissions costs: €43.1m (down from €46.3m) due to lower fuel prices but higher EU ETS charges.

Sustainability

- Dublin Swift and ISLE OF INISHEER trialling Hydrotreated Vegetable Oil (HVO), cutting emissions by up to 80%.

- EU ETS coverage rose to 70% of emissions in 2025.

- 80% of heavy terminal equipment now powered by renewable electricity.

- Ongoing trials with biofuels and battery-powered tugs for terminal operations.

Outlook

- Freight volumes strong; car volumes recovering on Ireland–UK and Ireland–France routes.

- Dover–Calais volumes impacted by capacity changes.

- Holyhead Port repairs continue into late 2025 and Q1 2026, with operational restrictions.

- New daily Dublin–Cherbourg service launched.

- EU Entry/Exit System (EES) will affect Dover–Calais and Ireland–France routes from late 2025.

- Continued regulatory cost pressure from EU ETS and FuelEU.

Read the full report here.