November 25, 2021

Irish Continental Group

- Consolidated Group revenue in the period was €279.7 million, an increase of €50.2 million or 21.9% compared with last year.

- This was partially offset by an increase in costs, primarily fuel which increased by €17m (60%) versus 2020 due to increased sailings and higher global prices.

- The Group remains in a strong financial position with cash and undrawn committed credit facilities at 31 October of €142.4 million and net debt of €114.4 million (pre-IFRS 16: €64.1 million).

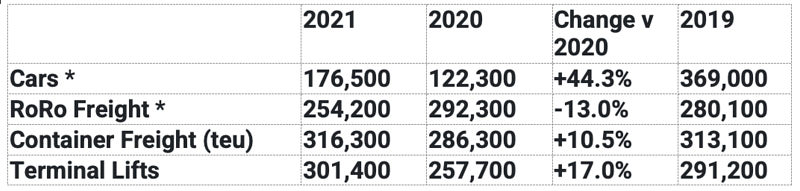

Volumes (Year to date, 20 November 2021)

Ferries Division (Irish Ferries)

- Improved trading conditions in its passenger business following the easing of travel restrictions across the EU in mid-July with the introduction of the EU Digital Covid Certificate.

- Brexit negatively impacting freight volumes but positively impacting freight revenue as more freight customers take the longer direct route to France.

- Total revenues recorded in the period to 31 October were €144.5m, up 24%.

- On a like for like basis (excluding Dover-Calais) over the same period, compared with 2020: Roro volumes are down 20% but roro revenue is flat as more customers use the Dublin-Cherbourg route where rates are higher given the longer journey time.

- Car volumes are up 16%

- The impact of Covid related restrictions has had a significant impact on Passenger traffic with car volumes year to date on a like for like basis (excluding Dover Calais) down 61% compared with 2019 but reassuringly with the easing of restrictions car volumes in the period 22nd Aug to 20th November 21 were only down 22% compared with the same period in 2019.

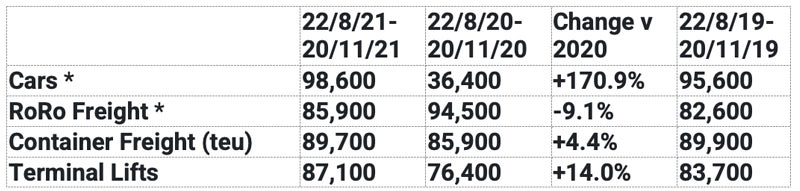

Volumes (since last Trading Update, 21 August 2021)