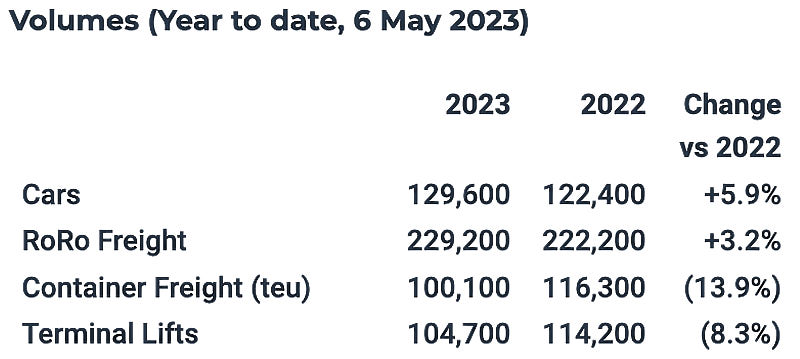

Financial information for the first four months of 2023

- Consolidated Group revenue +1.4% / €163.4 million

- Ferries Division +8.7% / €106.9 million (2022: €98.3 million)

- Container and Terminal Division -2.9% / €69.6 million (2022: €71.7 million)

Recent Developments

- On 5 May 2023, the Group took delivery of OSCAR WILDE (ex Tallink STAR) from Tallink Grupp. Long-term bareboat charter 20 months, charter option 2 + 2 years, purchase option.

Winston Framework

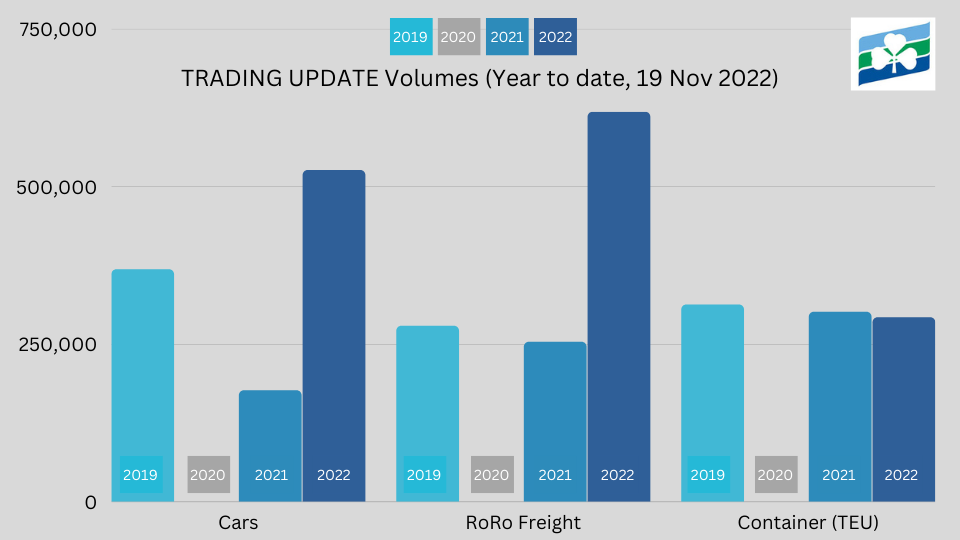

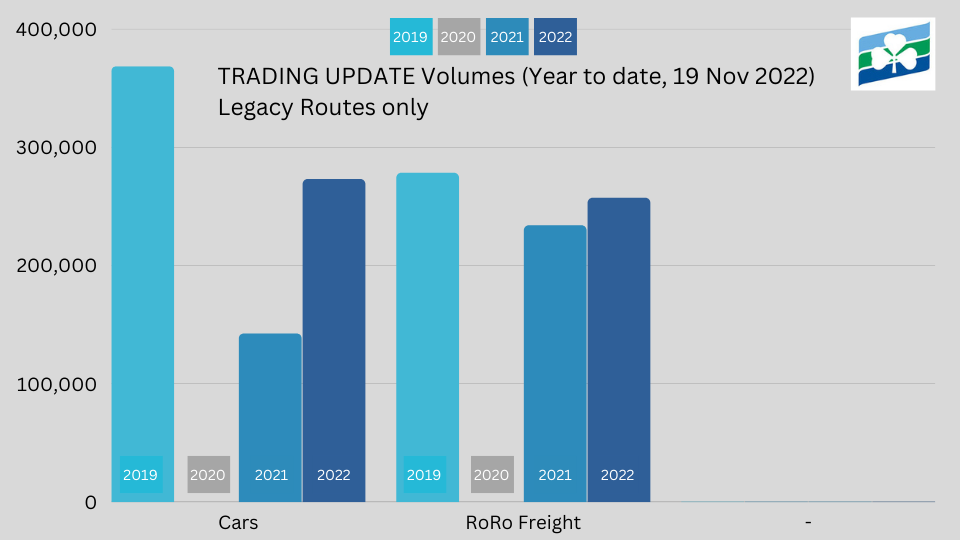

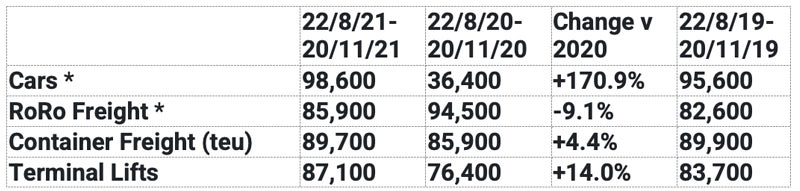

ICG expects 2023 will see a continuation of the trend of freight customers returning to the landbridge and we are hopeful that the Windsor Framework will remove the distortion from the non-implementation of the Northern Ireland Protocol.

ICG welcomes recent calls for the establishment of Green Lanes on ferry routes between the UK and the Republic of Ireland, for traffic destined for Northern Ireland. ICG believes that the arrangements proposed for Northern Ireland – Great Britain trade can be equally applied to allow trade to route via the Republic of Ireland. If a trader can be trusted to enter Northern Ireland and not enter the Republic of Ireland, then it would appear logical that the trader can be equally trusted to enter via the Republic of Ireland and go directly to Northern Ireland. This would allow Northern Ireland goods to travel via the shortest, most efficient, and environmentally friendly route. ICG has written to both the Irish Government and the European Union to urge them to consider the introduction of this proposal.

May 2023