As every year, Irish Continental Group (ICG) issues a trading update which covers carryings for the year to date to 19 November 2022 and financial information for the first ten months of 2022.

Consolidated Group revenue in the period was €500.5 million, an increase of 78.9% compared with last year and a 62.1% increase on 2019.

Net debt figures were €175.7 million compared to €142.2 million at year end. The increase is primarily derived from strategic capital expenditure mainly comprising the acquisition of two vessels.

Ferries Division (Irish Ferries)

+133.9% revenues to €338.0 million (first 10 months)

The increase was principally due to the easing of travel restrictions as compared to the same period last year, increased fuel surcharges and the new Dover – Calais service which commenced in June 2021.

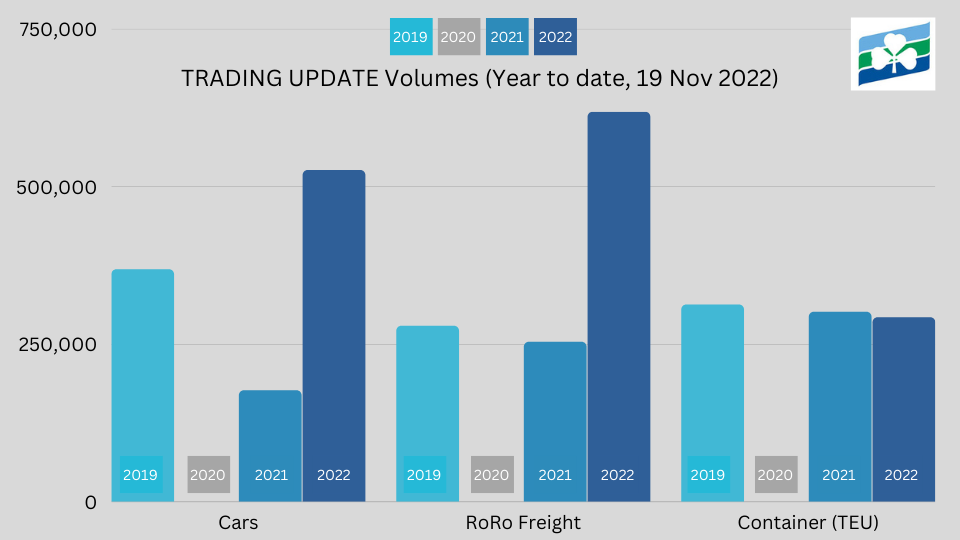

For the year to 19 November, Irish Ferries carried 525,600 cars, an increase of 198.0% on the previous year. Freight carryings were 618,100 RoRo units, an increase of 143.8% compared with 2021.

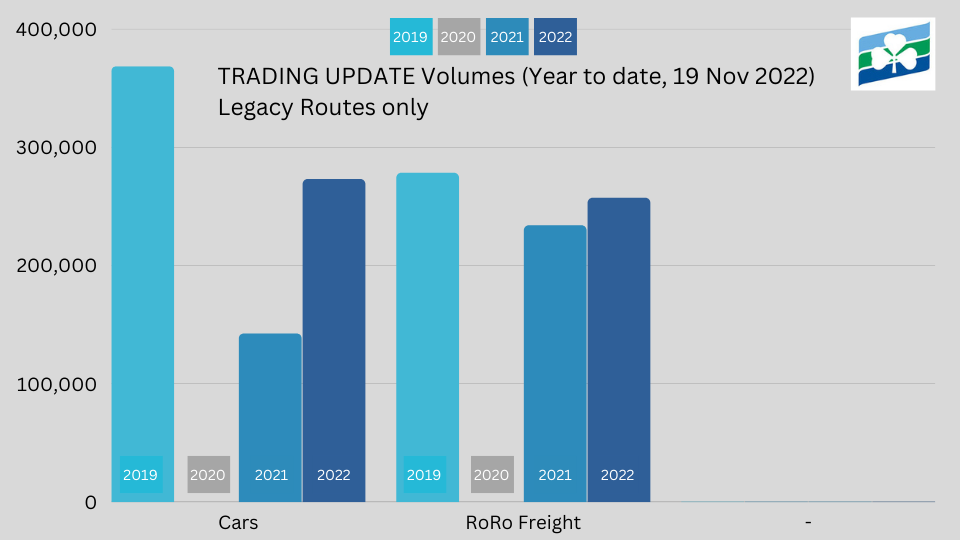

Excluding volumes on the Dover – Calais route, Irish Ferries carried 272,900 cars (an increase of 91.5% on 2021) and 257,000 RoRo freight units (an increase of 10.0%).

Outlook

The world is facing higher inflation and higher interest rates, both of which pose a challenging backdrop for economic growth.

Deep sea container movements are usually a leading indicator for economic slowdown and the recent weakness here is not unexpected.

The level of inflation faced by the business and our customers is concerning.

While fuel prices may ease versus earlier in the year with the expected slowdown in economic activity, other costs in the business have increased.

Confidence: “well placed to compete in this emerging tougher environment and to tap into whatever interesting opportunities might emerge.”