Summary of the financial report for Attica Group for the first half of 2024:

Revenue and Earnings:

- Group revenue increased by 29.9% to €317.2 million, compared to €244.3 million in the first half of 2023.

- EBITDA dropped to €19.5 million, from €47.5 million in the previous year.

- The Group reported a loss after taxes of €4.5 million, compared to earnings of €3.3 million in the first half of 2023.

- This period marked the first full semester integrating ANEK Lines following their merger in December 2023.

Operational Costs:

- The Group faced a 9% increase in average fuel prices and additional costs related to emissions allowances under the EU Emissions Trading System.

Asset Sales and Liquidity:

- Attica Group divested its stake in Africa Morocco Links (AML) and sold related vessels, generating a total gain of €22.8 million.

- Cash and cash equivalents increased to €157.8 million by June 30, 2024, from €103.4 million at the end of 2023.

- The Group fully repaid a €175 million bond loan in July 2024.

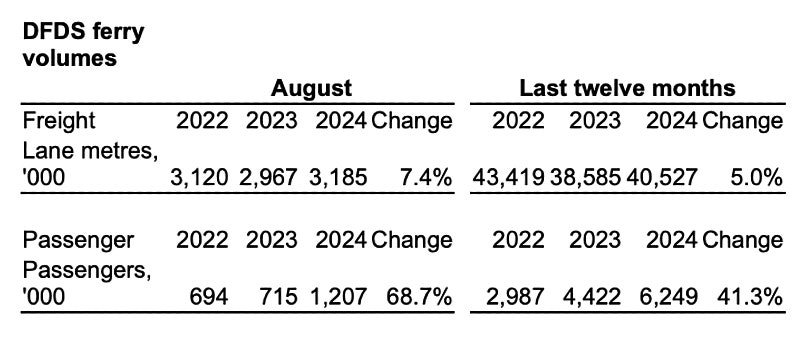

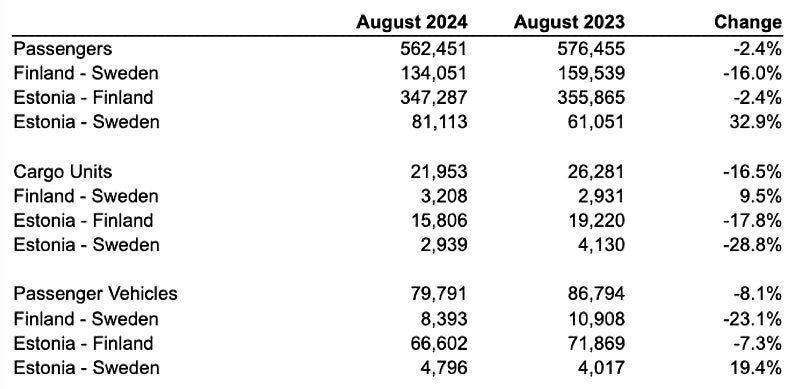

Fleet and Traffic Volumes:

- The Group’s fleet consists of 42 vessels, with significant increases in passenger, private vehicle, and freight unit volumes compared to the first half of 2023.

- Passenger traffic grew by 16.7%, private vehicles by 26.6%, and freight units by 27.3%.

Investments and Environmental Initiatives:

- The Group is investing in new methanol-ready and battery-ready vessels, with delivery expected in 2027.

- Continued expansion into the hospitality sector, including a €14 million investment in a hotel complex on Naxos Island.

Outlook:

The operational integration of ANEK is expected to complete by the end of 2024.

Source: Attica Group