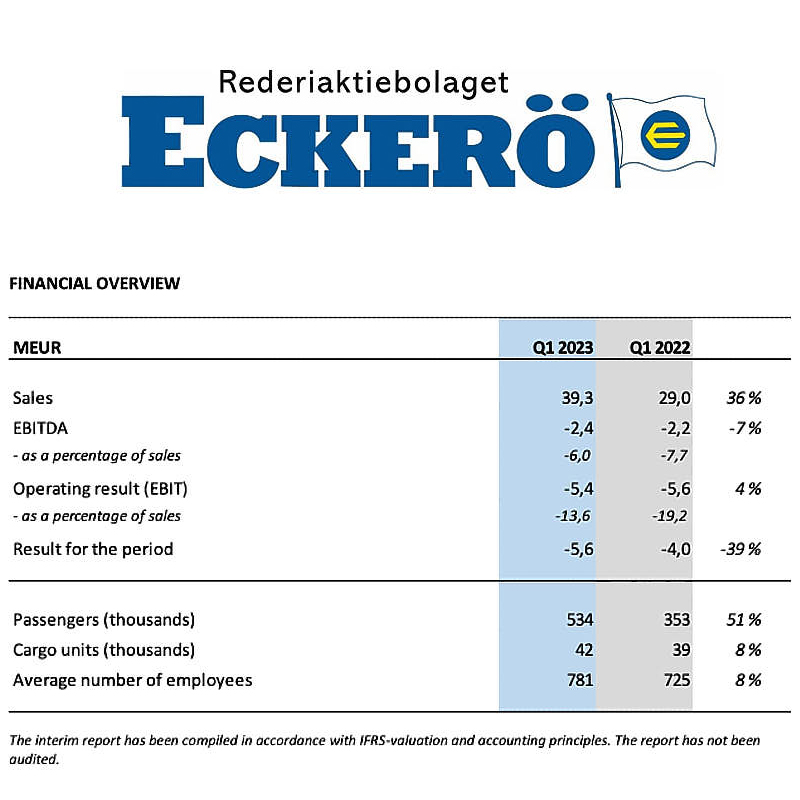

- +51 pax 534,178 ( (352,597)

- +8% cargo units 42,437 (39,129)

- +36% sales increased 39.3 MEUR (29.0 MEUR)

- Operating result amounted to -5.4 MEUR (-5.6 MEUR)

- Operating result improved by 37% compared to last year, adjusted for the cost support of 3.0 MEUR received from the Finnish Transport Authority for mandatory operations in Q1, 2022

- The operating result is the best operating result for the first quarter since 2010

- Result for the period was -5.6 MEUR (-4.0 MEUR)

- The sale of BIRKA STOCKHOLM was completed in April and the Group has amortized 19.6 MEUR on the Group’s interest-bearing liabilities since the sale of the vessel. After this, the Group’s net debt amounts to approximately 30 MEUR and the equity ratio improves from 35.1% as of 31.3.2023 to approximately 40% after the sale.

- More details here

January-March 2023 (EUR million)

- Sales EUR 93.9m (58.8m)

- Other operating revenue EUR 8.8m (6.0m)

- Operating income EUR -0.9m(EUR -18.1m)

- Net financial items EUR -3.5m (EUR -2.2m)

- Income before taxes EUR -4.4m (EUR -20.3m)

- Income after taxes EUR -3.7m (EUR -16.2m)

“Provided that energy prices remain at current levels and taking into account that capital gains are expected to be lower than in 2022, it is Viking Line’s view that income before taxes will be somewhat lower than last year, which is the same conclusion as in our last report period.”

- Pax 888,725 (521,537)

- Market share pax 35.4% (32.0%)

- Cargo units 33,736 (29,033)

- Market share cargo 17.5% (14.5%)

- Market share passenger cars 26.8% (25.1%)

In short: solid performance during the quarter that has historically been the most challenging for the group due to travelling low season. (unaudited)

- +45.7% pax

- -9% cargo units

- +61.3% consolidated revenue or EUR 171.2 million.

- EBITDA has seen a huge swing back into the positive compared to the last few years, reaching EUR 27.1 million in Q1 2023 (EUR –11 million in Q1 2022).

- Net loss for the period was EUR 5.4 million (net loss of EUR 40.0 million in Q1 2022).

The following operational factors impacted the Group’s revenue and operating results in Q1 of 2023:

- Growing demand for travelling supported by improving consumer confidence levels in all Group’s core markets.

- Ongoing war in Ukraine continues to impact the demand.

- During the quarter the Group operated 15 vessels including 3 shuttle vessels, 2 cargo vessels, 4 cruise ferries and 6 vessels that were chartered out (2 vessels on long-term and 4 vessels on short-term charter).

- The Group operated 3 hotels in Tallinn while the hotel in Riga remained closed since October 2020.

- Planned maintenance works totalled 45 days which affected the Finland-Sweden segment’s first quarter passenger and cargo levels as well as the financial result.

- The Group continues to focus on cost savings from previously implemented measures and achieving profitable operations on its core routes.

- The Group regularly monitors the developments on its core routes including the capacity of each route and continues to look for chartering options for vessels not used on the main routes.