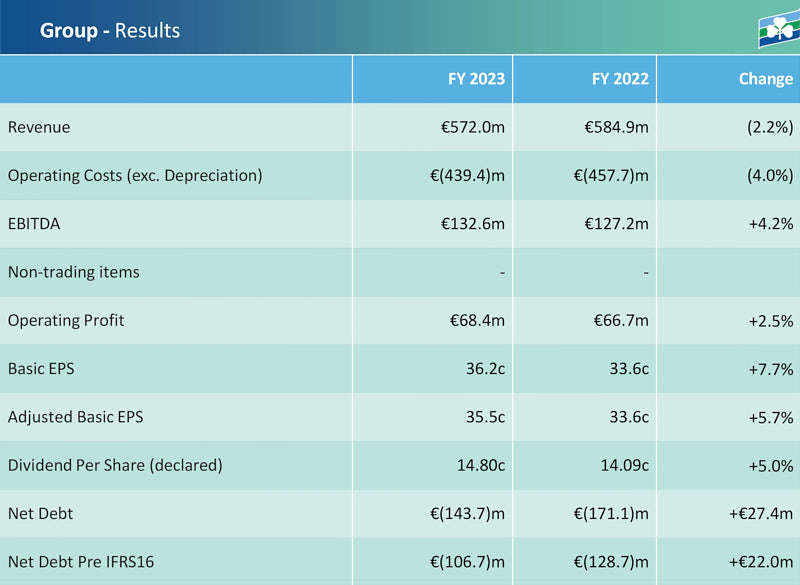

Irish Continental Group has reported a good year in 2024, with growth across its key financial and operational metrics. The company achieved revenue of €603.8 million, marking a 5.6% increase from 2023, while EBITDA rose 0.7% to €133.5 million. Operating profit also saw a modest rise of 1.0% to €69.1 million.

Growth in Key Segment Irish Ferries

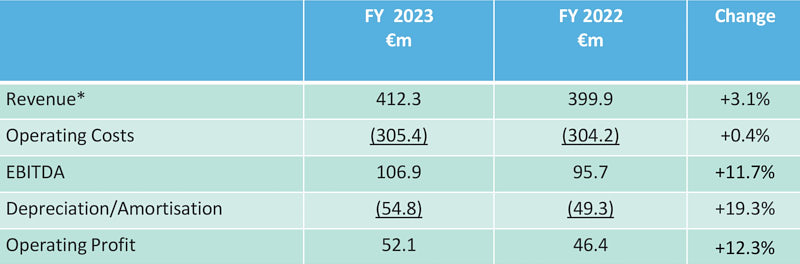

The Ferries Division demonstrated strong performance, with car carryings increasing by 9.5% to 707,300 and passenger numbers rising by 10.1% to over 3 million. RoRo freight units also grew by 6.0% to 767,200. A significant driver behind this success was the strategic expansion of Irish Ferries’ Dover-Calais operations, with the introduction of the newly acquired OSCAR WILDE (formerly SPIRIT OF BRITAIN), which entered service in June 2024.

“Our decision to expand onto the Dover-Calais route has proven to be a worthwhile investment, contributing to our strong performance despite broader market challenges” said Andrew Sheen, Managing Director of Irish Ferries.

Strategic Expansion and Market Positioning

Irish Ferries has long held ambitions to establish a strong presence on the Dover-Calais route, which represents a crucial freight corridor between the UK and France. The Channel market remains highly competitive, with Eurotunnel, DFDS, and P&O Ferries all vying for market share.

“Freight-wise, the Channel is a strong market for traffic from Britain, with an overall market of 4 million freight units split between ferries and the tunnel. We have always aimed to be present in strong markets,” said Andrew Sheen. “On short-sea routes: we can operate five return sailings on Dover–Calais, whereas a ship on the Ireland–France route can only manage one sailing per day. Hauliers are unlikely to pay the premium required to achieve the same return on an asset for a direct long route compared to a short-sea route. Strategically, short-sea routes have always been where we see the value.”

Irish Ferries has strengthened its position through a space charter agreement with P&O Ferries, enabling more efficient vessel utilisation and reducing haulier wait times.

This partnership, structured on a “turn up and go” basis, allows for seamless freight transportation between both operators’ vessels, offering hauliers increased flexibility. “It’s as close to a ‘floating bridge’ as you can get,” Sheen explained. “It enhances efficiency and levels the playing field in competition with the tunnel.”

While Brexit has not led to significant growth in the Ireland-UK freight market, there has been noticeable expansion on the Ireland-France and Britain-France routes. Irish Ferries’ network now provides a comprehensive landbridge solution for hauliers moving between Ireland and continental Europe, offering time savings compared to direct sailings from Ireland to France.

Operational Efficiency and Future Plans

The efficiency-driven approach of Irish Ferries is evident not only in its Dover-Calais operations but across its entire network. The company is actively exploring how its partnership with P&O Ferries can be extended to passenger traffic, with the aim of implementing a shared capacity arrangement ahead of the peak summer season.

Despite industry challenges, including fluctuating fuel costs and regulatory changes under the EU Emissions Trading System (ETS), Irish Ferries remains financially resilient. With a strong balance sheet and strategic investments, the company is well-positioned for the future.

Click image for more information