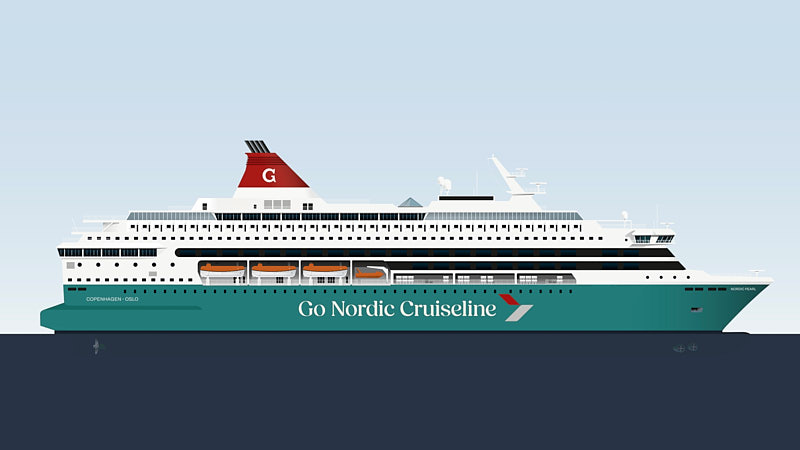

Gotlandsbolaget’s results for January–September 2025 show higher revenues and stable passenger numbers across the group. The acquisition of Go Nordic Cruiseline has more than doubled the number of employees and significantly increased turnover. However, establishment costs and lower-than-expected revenues continue to weigh on the cruise line’s result.

Quarter: July–September 2025

- Revenues: SEK 1,415.6m (1,002.7)

- Costs: SEK –1,079.1m (–695.1)

- Adjusted operating profit: SEK 352.7m (318.2)

- Profit after tax: SEK 311.1m (230.4)

The quarter was strengthened by Go Nordic Cruiseline’s first high season under Gotlandsbolaget. Passenger numbers reached 230,000, in line with 2024. Onboard revenues did not meet expectations and establishment costs remain high.

Gotland Alandia Cruises also contributed positively. 161,000 guests travelled on BIRKA GOTLAND, up 3% on the previous year.

Gotland traffic saw a 1% decline during the quarter, although June and August exceeded 2024 levels. Travel by Gotland residents increased by 6% for January–September.

Period: January–September 2025

- Revenues: SEK 2,985.3m (1,991.7)

- Costs: SEK –2,815.5m (–1,677.2)

- Adjusted operating profit: SEK 157.6m (278.8)

- Profit after tax: SEK 32.3m (322.7)

Dockings and upgrades of NORDIC PEARL and NORDIC CROWN reduced availability in Q1. Exchange-rate effects also had a significant negative impact compared to 2024.

CEO’s Comment

CEO Björn Nilsson highlighted revenue growth and the contribution from Go Nordic Cruiseline, but noted that 2025 remains an establishment year with high costs. He sees strong potential for both Go Nordic and BIRKA GOTLAND as their market positions strengthen.

Nilsson also emphasised progress in emissions reductions. By exceeding FuelEU Maritime requirements and selling surplus allowances, Gotlandsbolaget can finance increased use of renewable fuels. The order for GOTLAND HORIZON X supports this transition.

The CEO underlined the group’s Nordic footprint and continued commitment to Gotland’s development, including the investment in Brommaflyg and the partnership with Strawberry (hotels).