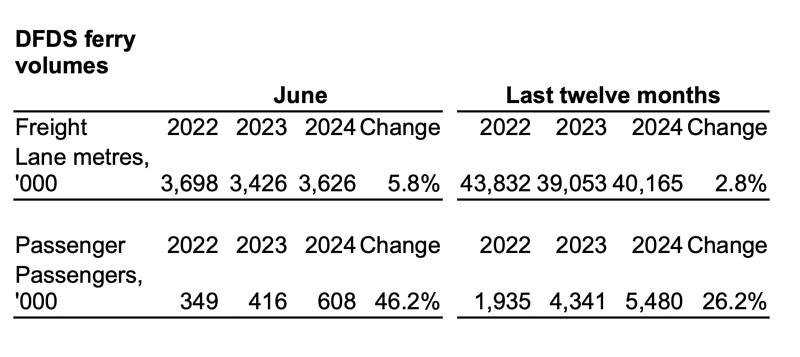

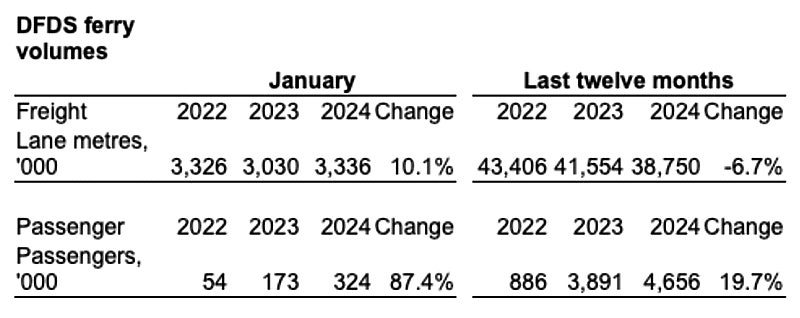

Ferry – freight:

- Total volumes in June 2024 were 5.8% above 2023 and up 0.9% adjusted for the addition of Strait of Gibraltar routes in 2024 and closure of the Calais-Tilbury route in 2023.

- North Sea volumes were below 2023 as higher volumes on the Swedish routes were offset by lower temperature controlled volumes, mainly food, between the Continent and the UK.

- Mediterranean volumes were also in June above 2023 driven by higher volumes on all routes.

- Channel volumes continued in June to be above 2023 as did volumes on the Baltic Sea routes.

- For the last twelve months 2024-23, the total transported freight lane metres increased 2.8% to 40.2m from 39.1m in 2023-22. The increase was 1.0% adjusted for the addition of Strait of Gibraltar routes and the Calais-Tilbury route closure.

Ferry – passenger

- The number of passengers in June 2024 was 46.2% above 2023 and up 11.1% adjusted for the addition of the Strait of Gibraltar routes.

- The adjusted increase continued to be driven mainly by higher Channel volumes.

- The number of cars were 26.2% above 2023 and up 3.6% adjusted for Strait of Gibraltar.

- For the last twelve months 2024-23, the total number of passengers increased 26.2% to 5.5m compared to 4.3m for 2023-22. The increase was 8.6% adjusted for Strait of Gibraltar.