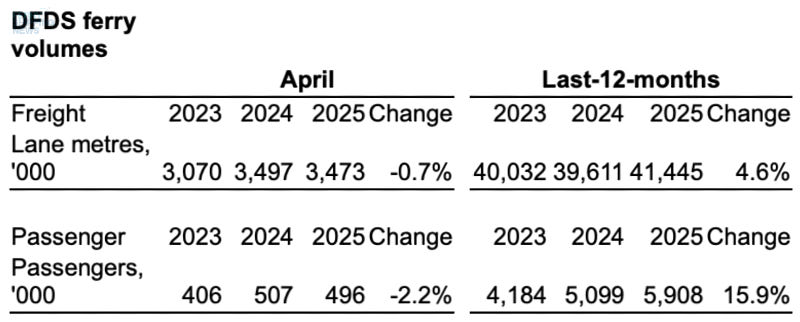

This year Easter holidays fell in April (last year in March). In general, this decreases freight volumes and increases passenger volumes.

RoRo – freight:

- Total volumes in April 2025 of 3.5m lane metres were 0.7% below 2024 and down 2.5% adjusted for route changes. YTD growth rates were -0.4% and -1.0%, respectively.

- North Sea volumes were below 2024 following primarily a dip in automotive volumes between Germany and the UK.

- Mediterranean volumes were above 2024 driven by mainly a shift of road volumes to ferry, a capacity increase between Tunisia and France, and the opening of a new route between Egypt and Italy.

- Channel volumes were below 2024 due to mainly the Easter timing difference.

- Baltic Sea volumes were below 2024 driven mostly by a temporary capacity reduction on one route following tonnage changes.

- Strait of Gibraltar volumes were above 2024.

- For the last twelve months 2025-24, the total transported freight lane metres increased 4.6% to 41.4m from 39.6m in 2024-23. The increase was 0.7% adjusted for route changes.

Ferry – passenger:

- The number of passengers in April 2025 was adjusted for route changes* up 15.1% to 432k vs 2024 and the adjusted YTD growth rate was -3.2%.

- The monthly increase was driven by mainly the Easter timing difference.

- The number of cars in April was 13.0% above 2024 adjusted for route changes.

- For the last twelve months 2025-24, the total number of passengers increased 15.9% to 5.9m compared to 5.1m for 2024-23. The increase was 3.7% adjusted for route changes.

*Adjusted for sale of Oslo-Frederikshavn-Copenhagen end October 2025, Tarifa-Tanger Ville due to considerable capacity changes ahead of exit from route early May 2025, and addition of Jersey routes from end March 2025.