Key Financial Figures (in EUR)

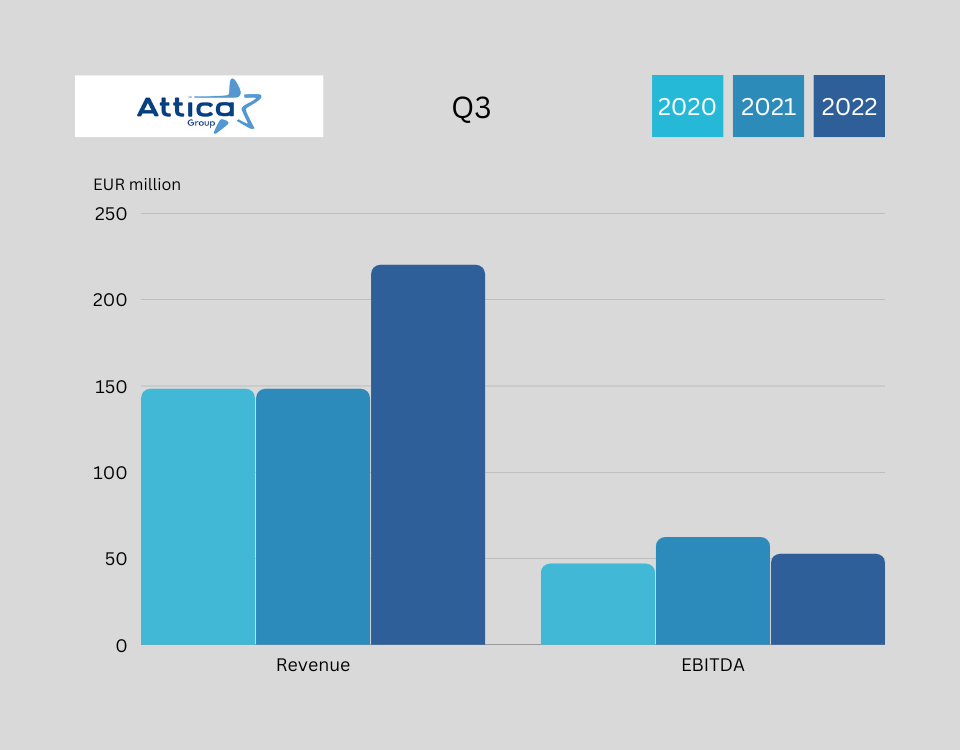

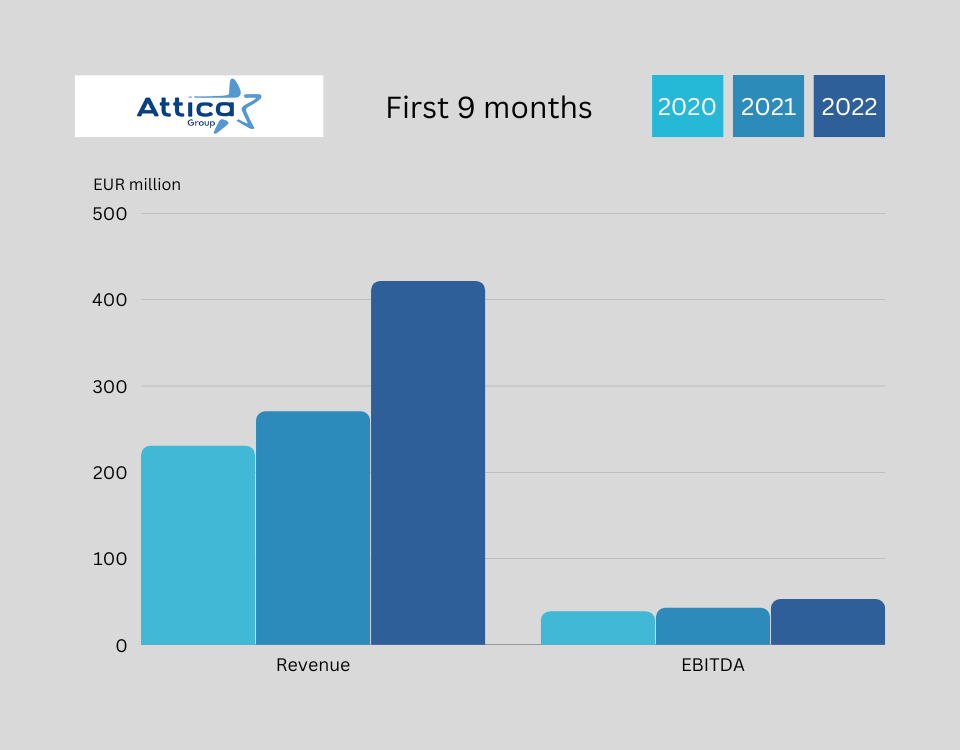

Revenue

Q3= 220.17mln = +48.45%

9M= 421.61mln = +55.86%

EBITDA

Q3= 62.33mln (47.11mln in the corresponding 2021 period)

9M= 52.73mln (42.74mln in the corresponding 2021 periods)

EBIT

Q3= 49.09mln (33.34mln in the corresponding 2021 period)

9M= 14.62mln (4.31mln in the corresponding 2021 period)

Consolidated Profit after taxes

Q3= 60.70mln (profit after taxes of 32.74mln in the corresponding 2021 period)

9M= 30.16mln (loss after taxes of 1.31mln in the corresponding 2021 period)

Outlook

For the forthcoming months of 2022, which constitute months of low traffic, the Group’s traffic volumes are expected to be at pre Covid-19 levels.

Others

The Group holds adequate liquidity with its cash and cash equivalents standing at Euro 75.67mln on 30.09.2022 compared to Euro 97.36mln as at 31.12.2021. Moreover, on 30.09.2022 the Group maintains undrawn credit lines amounting to Euro 15mln.

In October 2022, the Company has entered into bilateral credit facilities with three Greek credit institutions for a total amount of Euro 210mln and tenors from five to seven years, successfully concluding the long-term refinancing of all Group’s credit facilities maturing in 2022- 2023. The above agreements result in the reduction of the average interest rate margin of the Group.

Moreover, ICAP S.A., pursuant to its regular reassessment of the Company, upgraded its credit rating by one (1) notch by assigning it a ΑΑ credit rating (low credit risk zone).