Outlook firmed up by solid Q3, 2023

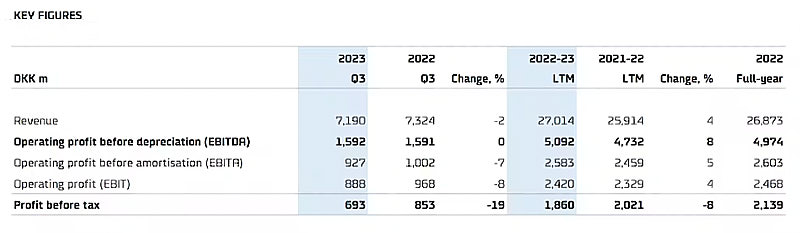

- Q3 EBITDA of DKK 1.6bn was ahead of expectations.

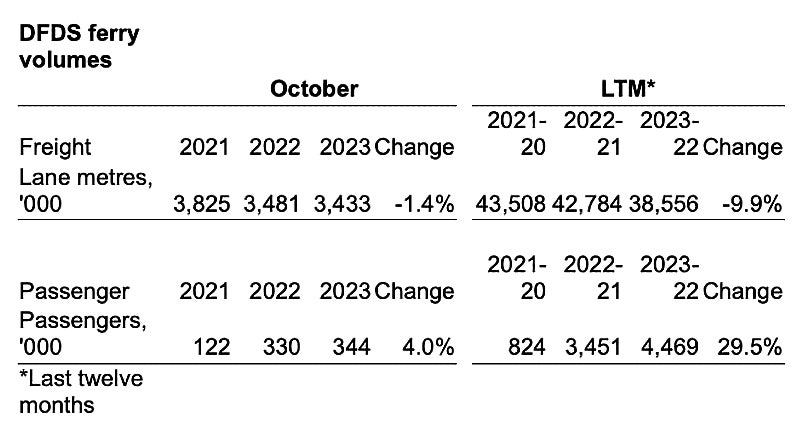

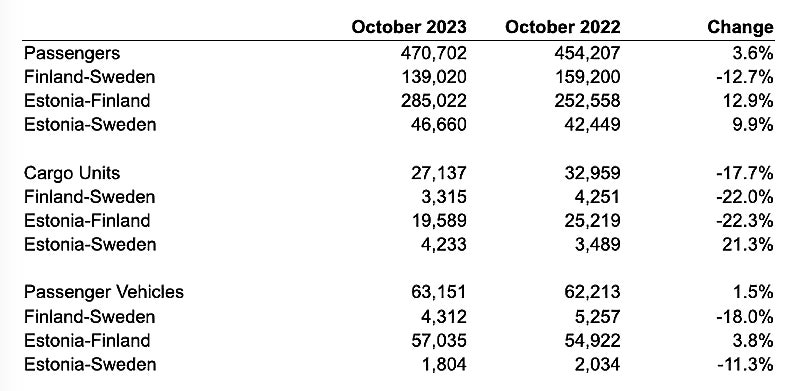

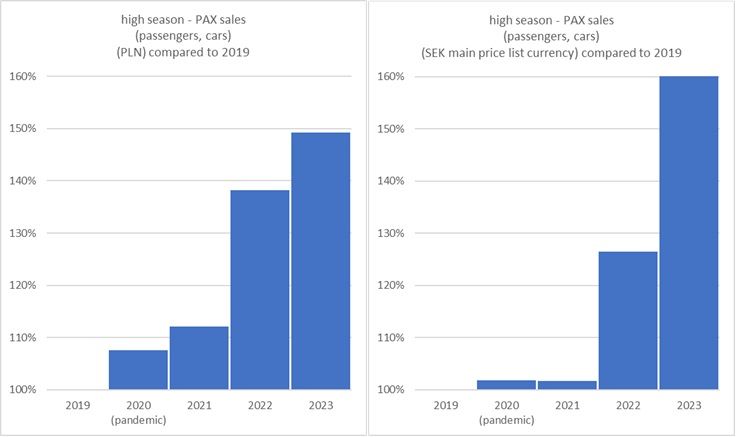

- Passengers: strong high season.

- Freight: performance as expected below last year.

- Revenue decreased 2% to DKK 7.2bn

- Cash flow further improved.

- EBITDA outlook firmed up to DKK 4.9-5.2bn (DKK 4.8-5.2bn).

“We have firmed up our outlook on the back of a solid quarter, not least a very good passenger result. Freight markets are currently challenging, and we continue to adapt our ferry and road capacity to optimise utilisation.”

Torben Carlsen, CEO

Key freight outlook assumptions for 2023:

- Q4 Freight Ferry Volumes: Expected to be on par with the volumes from the previous year.

- Logistics Activity Levels: Anticipated to be below the levels seen in the previous year.

- 2023 Q4 Passenger Volumes: Expected to be higher compared to the same period in the previous year.

- Revenue Outlook: Overall Group revenue expected to remain at around the same level as 2022. Higher passenger and logistics revenue offset by lower revenue primarily from bunker surcharges.

- Earnings Outlook: The Group’s EBITDA for 2023 is expected to be within a range of DKK 4.9-5.2 billion. This is a slight adjustment from the previous range of DKK 4.8-5.2 billion provided earlier. In 2022, the EBITDA was DKK 5.0 billion.

The improved outlook is attributed to better than expected earnings in the Ferry Division, while the Logistics Division faces more challenging market conditions, leading to a reduced outlook in that segment.

“Every Minute Counts”

Continued improvements in the quarter ensured that short-term emission reductions targeted towards 2030 continues to be on track. Ferry improvements were driven by various incremental vessel upgrades and the schedule optimisation program “Every Minute Counts” focused on reducing turnaround time in port terminals, and updated schedules enabling lower speed and reduced fuel consumption.

Ferry CO2 emissions per GT nautical mile were in Q3 2023 reduced 4% compared to Q3 2022 across the route network.