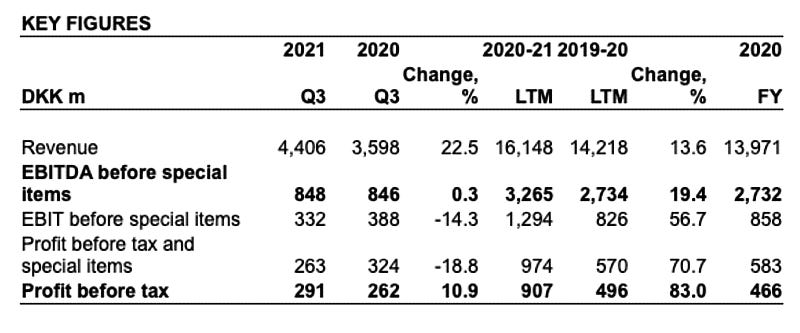

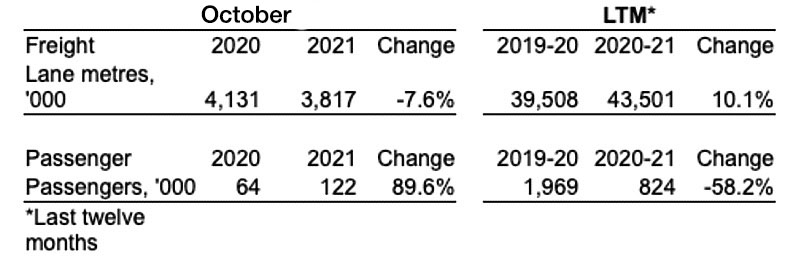

- Revenue increased 22% to DKK 4.4bn driven by higher freight activity in most business units.

- Q3 passenger activity was overall below 2020 but picked up in the last month of the quarter.

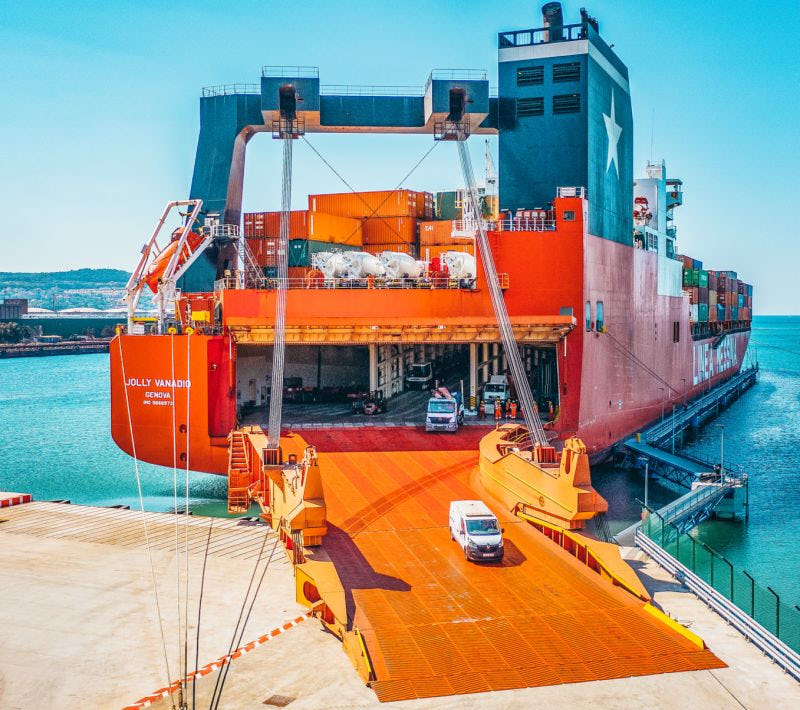

- The total freight EBITDA for ferry and logistics before special items increased 6% to DKK 795m driven mainly by strong growth in the Mediterranean business unit.

- The total passenger EBITDA for passenger services in the Baltic Sea, Channel, and Passenger business units decreased DKK 43m or 45% to DKK 53m.

- Total EBITDA of DKK 848m was on level with 2020.

- Supply chain bottlenecks became more widespread in Europe during Q3, including a high level of impact in the UK. This entailed extra operating costs for both freight ferry, port terminal and logistics activities. In addition, freight volumes to the UK were for periods in Q3 capped which lowered utilisation on ferry routes.

Outlook 2021

- The outlook for freight activities remains overall positive, although the current slowdown in UK trade flows is expected to continue in Q4 2021.

- Passenger travel is expected to continue to pick up.

- Revenue growth outlook is now expected at 23-25% (20-25%).

- The EBITDA outlook range before special items is now expected at DKK 3.3-3.5bn compared to previously DKK 3.2-3.6bn (2020: DKK 2.7bn).

- The outlook is detailed on page 10 in the full report.