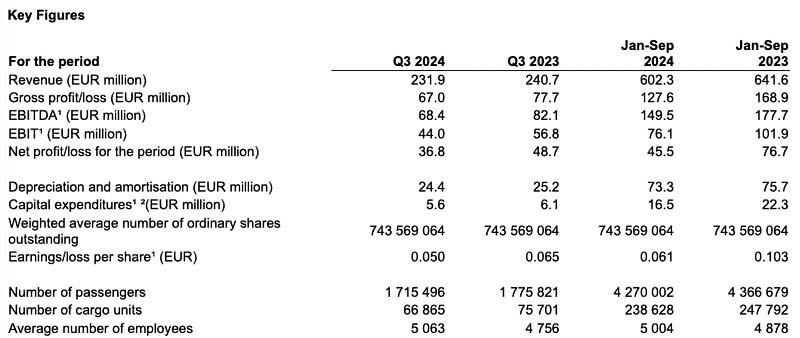

Q3

- Passengers:

Tallink Grupp carried 1,715,496 passengers in Q3 2024, a 3.4% decrease from 1,775,821 in Q3 2023. - Trips:

The company operated 1,840 trips in Q3 2024, an increase of 131 trips compared to 1,709 trips in Q3 2023. - Revenue:

Revenue for Q3 2024 was EUR 231.9 million, a 3.7% decline from EUR 240.7 million in Q3 2023. - EBITDA:

EBITDA for Q3 2024 stood at EUR 68.4 million, down 16.7% from EUR 82.1 million in Q3 2023. - Net Profit:

Q3 2024 net profit was EUR 36.8 million, a 24.4% decrease compared to EUR 48.7 million in Q3 2023. - Liquidity Buffer:

At the end of Q3 2024, the company’s liquidity buffer amounted to EUR 107.6 million, compared to EUR 199 million at the end of Q3 2023. - Investments:

Investments in Q3 2024 were EUR 5.6 million, down from EUR 6.1 million in Q3 2023. - Loan Repayments & Dividends:

The company repaid loans worth EUR 27 million and made dividend payments of EUR 44.6 million in Q3 2024.

First Nine Months (1 January – 30 September 2024):

- Revenue: EUR 602.3 million, a 6.1% decline from EUR 641.6 million in the same period in 2023.

- EBITDA: EUR 149.5 million, down from EUR 177.7 million in 2023.

- Net profit: EUR 45.5 million, down from EUR 76.7 million in 2023.

The financial result of the first 9 months of 2024 was impacted by the following factors:

- Low consumer and business confidence in the home markets as well as mounting geopolitical tensions.

- The number of vessels on charter dropped from 5 in the beginning of the year to 3 as at the end of the third quarter.

- Sale of the cruise vessel Isabelle in the first quarter of 2024.

- Two vessels in lay-up including the cruise vessel Romantika the charter agreement of which was prematurely terminated in September 2023 and MV Superfast IX (formerly Atlantic Vision) the charter agreement of which ended in May 2024.

- Payment of dividends in the amount of EUR 44.6 million in the third quarter of 2024.

- Income tax expense on dividends in the amount of EUR 9.2 million was recorded in the second quarter of 2024. In the third quarter of 2024, income tax on dividends was paid in the amount of EUR 4.9 million (EUR 4.3 million of the dividend tax expense was offset by prepaid income tax).

- Repayment of long-term loans in the amount of EUR 59.5 million.

CEO’s Outlook (Paavo Nõgene):

Despite challenging market conditions and the fragile economic environment, Tallink Grupp’s third quarter results are strong. With two vessels suspended, the company has still managed to deliver confidence-inspiring results. The company remains lean and aims to reinstate its regular dividend payments in 2025, barring any unforeseen disruptions during the remainder of the year.

For a more detailed report: Tallink Newsroom