Gotlandsbolaget closed 2022 with a strong negative operating result, above all due to extreme fuel prices. One of the measures taken to stop an escalating continued loss, was that Destination Gotland adjusted the ticket prices. The operating profit for the first quarter of 2023 is, as expected, negative due to the low season, but stabilized fuel prices and the effect of the decisions taken at the end of 2022 lead to an improvement compared to the same period in 2022.

The stabilized fuel prices have meant that Destination Gotland has been able to lower its ticket prices from April and forwards.

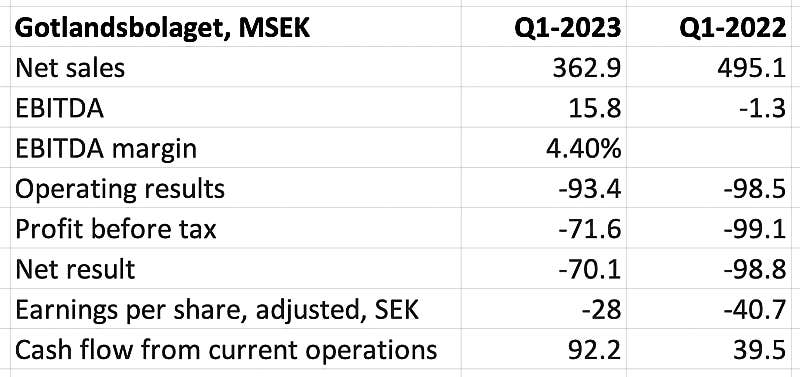

Quarter January-March 2023

Revenues and costs during the quarter are lower than the previous year mainly as a result of items relating to Stockholms Reparationsvarv and Hansa Destinations being included, as well as for the four product tankers that were sold in autumn 2022.

Adjusted operating profit amounted to SEK -62.9 million (-98.5), corresponding to SEK -25.2 (-39.4) per share. The improvement is due to the previous year’s result being burdened by a negative result for Hansa Destinations, as well as adjusted prices in Gotlandstrafiken and the fact that the price of fuel has stabilised.

Revenues and results are normally low during the first quarter as a result of the low season for Gotland’s hospitality industry, which also historically means a negative result.

Net sales losses on the sale of the vessels VALENTINE and HSC GOTLANDIA amounted to SEK -30.5 million.

The complete interim report for the period January to March 2023 is available here in Swedish.