DFDS Expands Into the Med By Acquiring U.N. Ro-Ro

In a company announcement, DFDS says it acquires U.N. Ro-Ro, the Turkish operator of freight shipping routes in the Mediterranean, connecting Turkey with Italy and France.

This means a geographic expansion of the DFDS route network, with a considerable expansion in the Mediterranean.

DFDS is to acquire 98.8% from owners, the Turkish private equity firms Actera Group and Esas Holdings.

U.N. Ro-Ro is highly profitable, with an enterprise value of EUR 950 million.

“With the acquisition of U.N. Ro-Ro, we are expanding into one of Europe’s most attractive freight markets which is operationally similar to northern Europe. This gives us opportunity together with the existing strong management team to leverage our network, fleet, experience and skills to develop the business further while supporting the growth of U.N. Ro-Ro’s customers”, says Niels Smedegaard, CEO of DFDS.

The transaction is subject to approval by the Turkish, Austrian and German competition authorities as well as Italian authorities in relation to the transfer of the Trieste terminal as a strategic asset. Closing of the transaction is expected to take place in June 2018.

U.N. Ro-Ro operates five freight shipping routes in the Mediterranean between Turkey and EU: four routes connect to Italy (Trieste) and one to France (Toulon).

The routes carried 202,000 freight units in 2017.

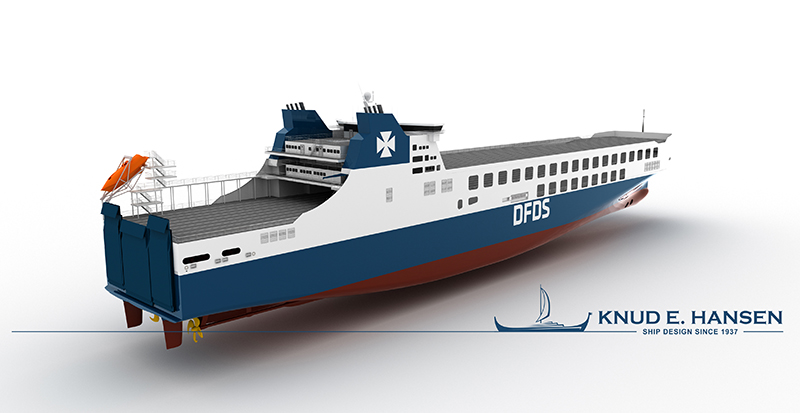

By the end of 2017, U.N. Ro-Ro deployed 12 ro-ro ferries, all built by the Flensburg shipyard, where also some of DFDS’ ships are built.