Danish Companies Join Forces On An Ambitious Sustainable Fuel Project

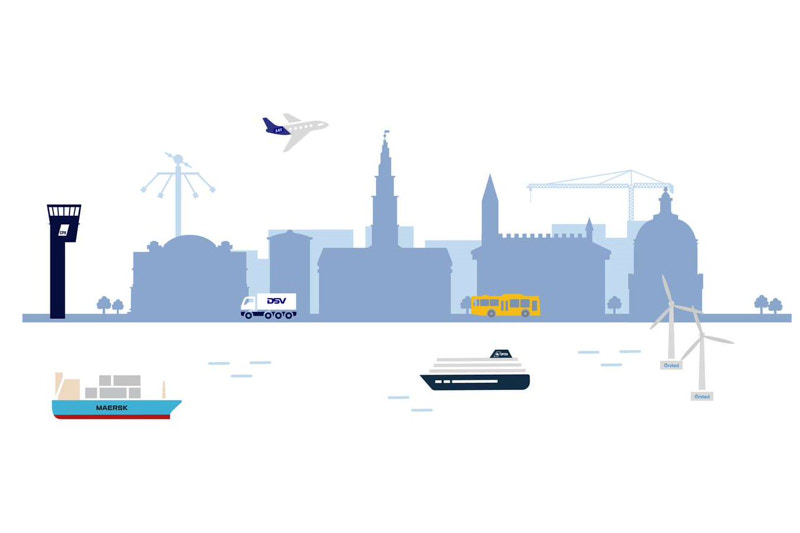

DFDS has together with Copenhagen Airports, A.P. Moller – Maersk, DSV Panalpina, SAS and Ørsted formed the first partnership of its kind to develop an industrial-scale production of sustainable fuels for road, maritime and air transport.

The joint vision is to establish one of the world’s largest electrolyser and sustainable fuel production facilities

When fully scaled-up by 2030, the project could deliver more than 250,000 tonnes of sustainable fuel for busses, trucks, maritime vessels, and airplanes every year. Production would potentially be based on a total electrolyser capacity of 1.3 gigawatts, which would likely make it one of the world’s largest facilities of its kind. The production from the fully scaled facility can reduce annual carbon emissions by 850,000 tonnes.