COSCO Urges For Further Investments In Piraeus Port

According to a recent report:

- COSCO Shipping served in total 26.7 million TEU worldwide

- Traffic increased by 1.8% compared to 2019

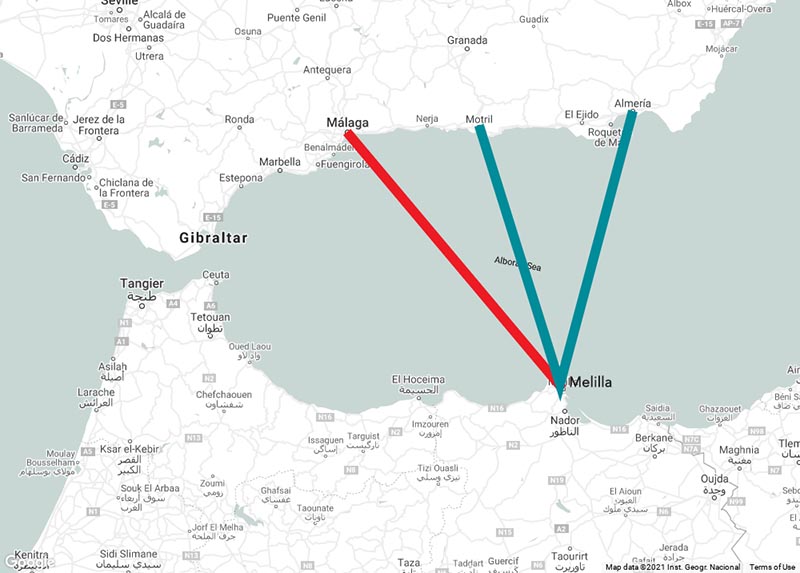

- COSCO is concerned about the fact that ports that were far behind Piraeus still competing. A typical example is the port of Tangier, which served 5.7 million TEU, operating three piers. Investments are being made in order to increase capacity to 9 million TEU.

- COSCO is concerned because the Greek Government does not approve the construction of Pier IV that will increase the port’s capacity to 10 million TEU.

- If Pier IV is not built, then Piraeus Port will lose customers as well as its geostrategic footprint.