November 14, 2024

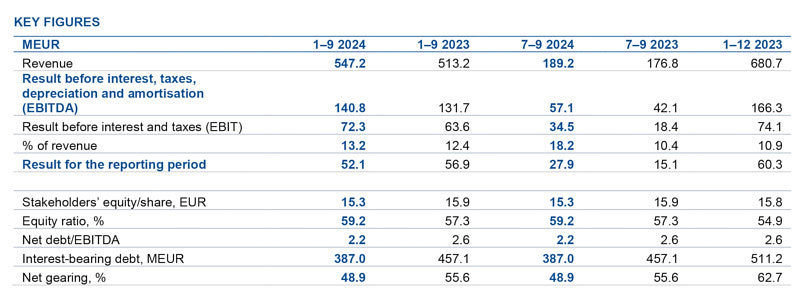

- Revenue: Reached €547.2 million, a 7% increase from €513.2 million in 2023.

- EBITDA: Improved by 7% to €140.8 million, up from €131.7 million in the previous year.

- Net Income: Decreased by 8%, resulting in €52.1 million, compared to €56.9 million in 2023.

- Debt Reduction: Interest-bearing debt dropped by €70.1 million to €387 million.

Q3 2024 Highlights:

- Revenue: Increased by 7% to €189.2 million.

- EBITDA Growth: Saw a substantial 36% rise to €57.1 million.

- Net Income: Notably grew by 85%, reaching €27.9 million.

Operational Updates:

- Passenger travel surged, especially on the Naantali–Långnäs–Kapellskär route, with a 122% increase.

- A new UK freight route was launched, connecting Finland and Sheerness.

- Fleet modernisation continues, aligning with environmental regulations; three new green-fuelled vessels are in procurement.

Outlook: Finnlines anticipates improved performance, supported by EU economic recovery, operational efficiencies, and green initiatives. However, some concerns:

- Economic Headwinds: The beginning of 2024 saw challenges from high interest rates, inflation, and slow economic growth, especially in key markets such as Finland, Germany, and Sweden. These factors have affected freight and passenger demand, though signs of recovery are emerging.

- Geopolitical Tensions: Ongoing conflicts, particularly the Ukraine crisis, add uncertainty to the business environment. Any escalation could impact trade flows within the EU and Finnlines’ routes.

- Labour Disruptions: Early 2024 saw strikes in Finland that disrupted cargo volumes. Although impacts seem contained, further labour issues could hinder operations and revenue growth.

- Cybersecurity Risks: The increased likelihood of cyberattacks has led Finnlines to focus on cybersecurity measures, essential for safeguarding operations but requiring continuous investment and vigilance.

- Environmental Compliance Costs: Finnlines is aligning with the EU’s new environmental regulations, including the Emissions Trading Scheme and Fuel EU Maritime regulations starting in 2025. Compliance necessitates significant investment in new vessels and technology, increasing capital expenditures.

- High Debt Levels: While debt decreased, Finnlines still carries substantial interest-bearing debt (€387 million), making it sensitive to any future interest rate increases that could impact financial expenses.

Overall, Finnlines is navigating these risks by investing in fleet modernisation, expanding routes, and implementing efficiency measures, which should help mitigate some of these concerns over time.