August 22, 2025

Q2 2025

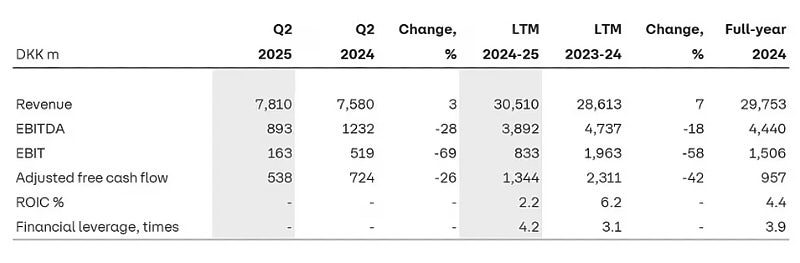

- Revenue: DKK 7.8bn (+3%, organic –2%)

- EBIT: DKK 163m (–69%)

- Adjusted free cash flow: DKK 538m (–26%)

- CO₂ ferry emission intensity: –4.1%

Outlook 2025

- EBIT: DKK 0.8–1.0bn (previously ~DKK 1.0bn)

- Revenue growth: ~5%

- Adjusted free cash flow: ~DKK 1.0bn (unchanged)

CEO’s comments

- Most of the network performed as expected.

- Mediterranean remains the key earnings challenge.

- Logistics Boost turnaround on track.

- Türkiye & Europe South turnaround slower; breakeven may be delayed.

Geopolitics

- New EU–USA trade deal sets a 15% tariff on EU exports to USA.

- Short-term EU growth may be impacted.

- Nearshoring expected to accelerate trade with Türkiye and Morocco, benefiting DFDS’s network.

Read the Q2 2025 interim report

Or click on this cover below for the full presentation: