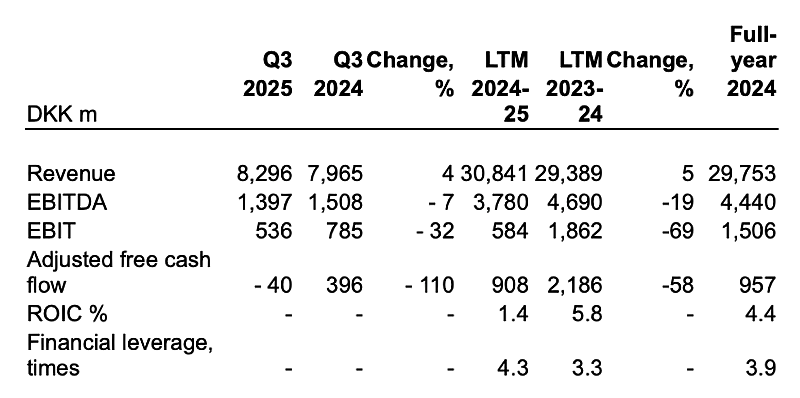

Key figures

- Revenue up 4% to DKK 8.3bn (organic growth -2%)

- EBIT down 32% to DKK 536m

- CO₂ ferry emission intensity lowered 2.7%

Outlook 2025

- EBIT lowered to DKK 0.6–0.75bn (previously DKK 0.8–1.0bn, excl. one-off cost)

- One-off cost of around DKK 100m in Q4 for Cost Reduction Programme

- Adjusted free cash flow now expected around DKK 0.9bn (down from DKK 1.0bn)

CEO’s Comments

2025 is a transitional year for DFDS, setting the stage for stronger financial performance after a challenging 2024. A new Cost Reduction Programme targets DKK 300m savings in 2026.

Focus Areas

- Logistics Boost: Progressed in line with expectations; further gains expected in Q4.

- Mediterranean Network: New pricing model (launched Sept 2025) shows initial yield recovery.

- Türkiye & Europe South: Improvement slower than expected amid tough markets.

Network Performance

Results outside the focus areas were solid and exceeded 2024 levels (adjusted for route changes).

- North Sea: Stable freight operations.

- Baltic Sea: Strong quarter; further improvement expected via new space charter.

- Channel: Good performance despite extra costs for Jersey routes.

- Strait of Gibraltar: On target; two additional ferries to join in 2026 (pending approval).

- Logistics: Nordic and Continent units adapted to low growth; UK & Ireland remained stable.

Outlook Summary

EBIT outlook revised down due to uncertainty in Mediterranean ferry and logistics activities, plus one-off programme costs.

Read the DFDS Q3 2025 Interim Report here.