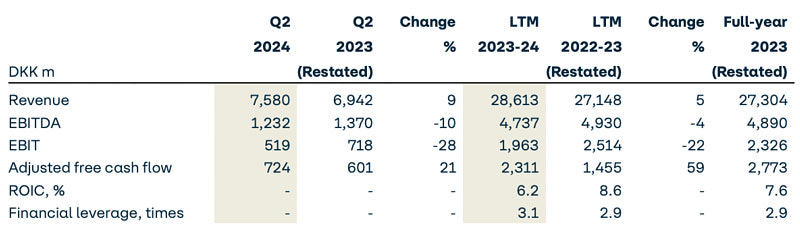

The Q2 results were below expectations in spite of organic growth and increased revenue.

Trend: Freight Ferry down, Passenger ferry up.

Main elements:

- Revenue up 9% to DKK 7.6bn

- EBIT reduced 28% to DKK 519m

- Ferry Q2 EBIT decreased 21% or DKK 133m to DKK 508m driven by lower freight result

- Logistics Q2 EBIT decreased 41% or DKK 60m to DKK 85m driven by margin pressures, shift in customer flows, and underperformance in Nordic Cold Chain.

- EBITDA decreased 10% or DKK 137m following lower results in both the Ferry Division and the Logistics Division.

- Freight Ferry EBITDA down 8% or DKK 60m excluding DKK 54m decrease in oil spread hedging income. Organic decrease driven by rate pressures and adverse cost development

- Passenger EBITDA up DKK 25m due to higher volumes and spending in Channel.

Comments from CEO Torben Carlsen:

- We revised the earnings outlook for 2024 while maintaining the adjusted free cash flow outlook.

- The top priorities for the rest of the year are to continue to protect our key ferry market positions and turn Logistics’ earnings trend around.

- In parallel with addressing these priorities, we will continue to unlock the value of our expanded network and to move our green transition forward.

- We continued in Q2 to protect our strategic Baltic and Channel ferry market positions in market environments with rate pressure from overcapacity and limited volume growth. Our ability to fully pass on cost increases is therefore currently reduced.

- We are confident that the short-term protection of our route network will ensure long-term growth and resilience as markets over time move to rebalance supply and demand.

- A large part of our Logistics’ network is performing well in the face of a challenging market environment with heightened margin pressure and large shifts in customer flows in our Belgian and Dutch operations. Key focus areas in the rest of the year are to further adapt the cost base to the current pricing environment and to grow volumes organically.

- In addition to market impacts, Logistics’ Q2 result was lowered by underperformance of the Nordic Cold Chain business unit. We expect to complete the ongoing turnaround of the Nordic unit by year-end.

- Overall, we expect Logistics Division’s Q3 result to remain below 2023 while the Q4 2024 result is expected to exceed 2023.

Outlook 2024

- The EBIT outlook range was lowered to DKK 1.7-2.1bn from previously DKK 2.0-2.4bn following a Q2 result below expectations and continued market headwinds expected for the rest of year.

- Revenue growth of 8-11% (unchanged)

- The adjusted free cash flow outlook is unchanged around DKK 1.5bn.

Green Strategy 2024-2030

- 45% reduction in ferry emission intensity.

- Six green ferries in operation by the end of 2030.

- 75% reduction of land emission intensity.

CLICK IMAGE BELOW TO VIEW POWERPOINT