BC Ferries released its Q2 results for the three and six months ending September 30, 2022. Vehicle and passenger traffic, revenue and net earnings are all higher compared to the same periods in the prior year.

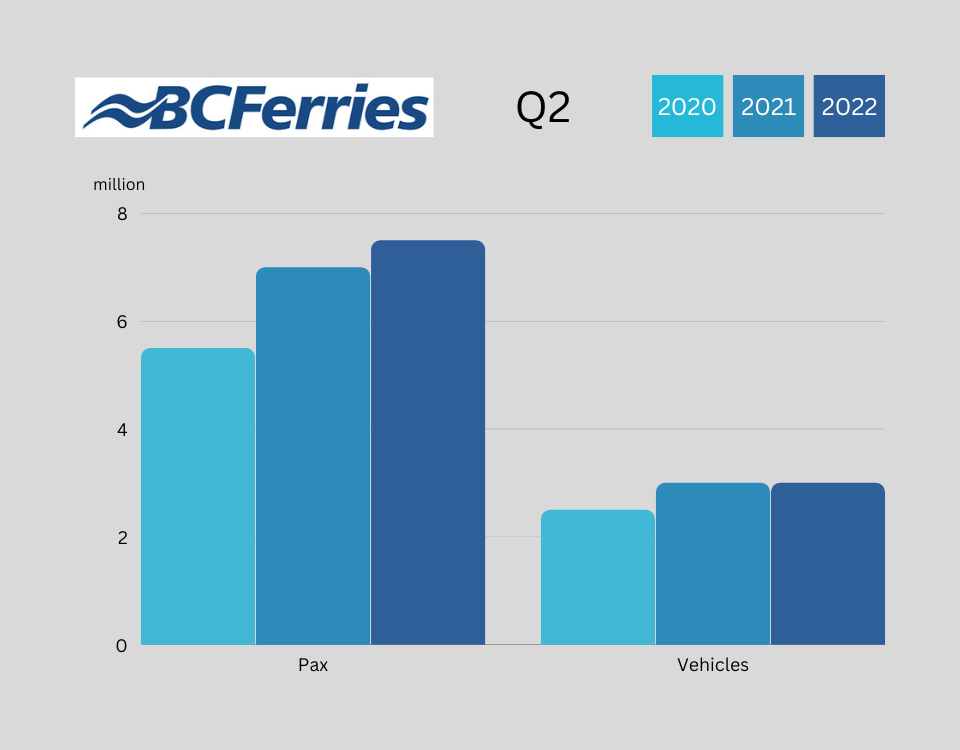

In Q2, the quarter ending September 30, 2022, BC Ferries carried 7.5 million passengers and 3.0 million vehicles.

Year-to-date, the company carried 12.9 million passengers (+28%) and 5.4 million vehicles (+15%) respectively, compared to the same period in the prior year, primarily as a result of travel restrictions being in place through most of Q1 in the prior year.

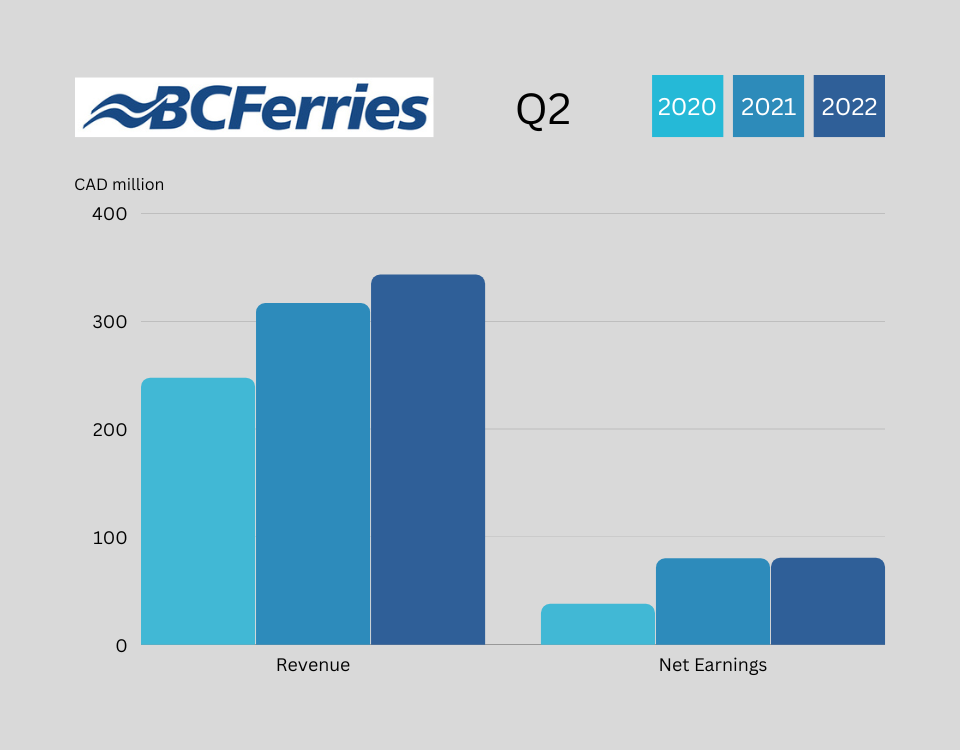

BC Ferries’ net earnings for Q2 were $80.4 million, consistent with the same quarter the previous year.

Year-to-date since April 1, 2022, net earnings were $88.3 million compared to net earnings of $84.6 million in the prior year.

Revenue for the three months ending September 30, 2022, at $343.1 million, was up $26.3 million over the same period in the prior year primarily as a result of higher passenger traffic volumes, net retail sales, ferry transportation fees and fuel surcharges.

Year-to-date, revenue was $608.0 million, up $62.0 million over the same period in the prior year primarily as a result of higher traffic volumes, net retail sales and fuel surcharges partially offset by lower Safe Restart Funding.