- Q3 EBITDA up 88% to DKK 1.59bn

- Higher earnings in all business units

- Passenger earnings 11% above 2019 (pre-Covid-19)

- Financial leverage of 2.9x back in target range

- Full-year EBITDA outlook raised to DKK 4.8-5.0bn

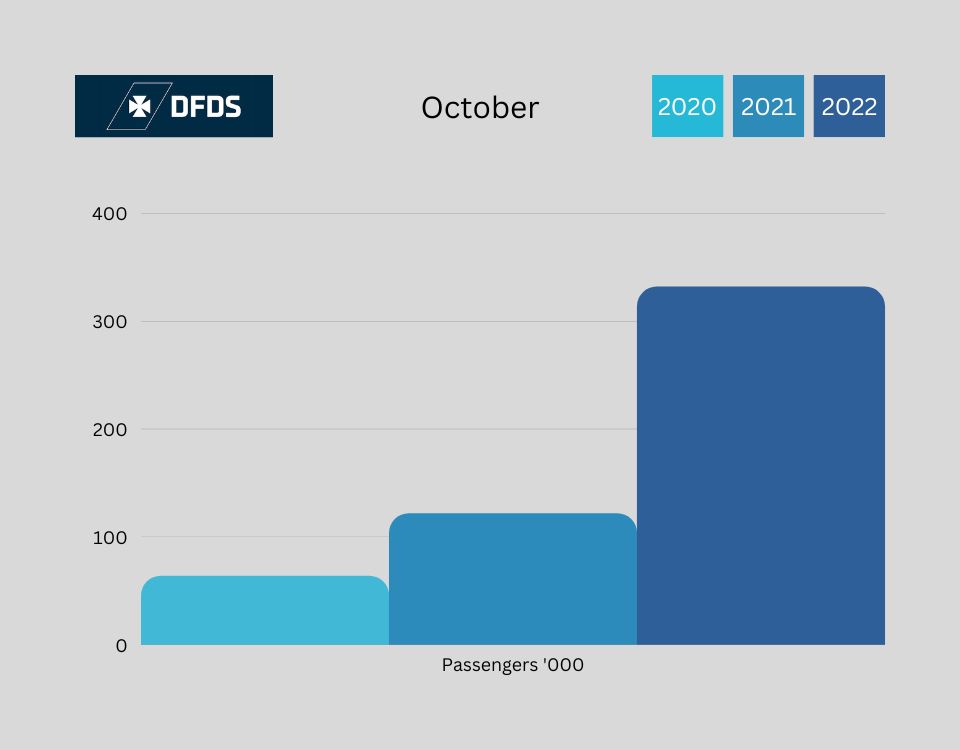

Group revenue increased 64% to DKK 7.2bn driven by the continued recovery in passenger numbers and spending, as well as price increases for freight services to cover rising energy and other costs. Revenue was also increased by the acquisitions of HSF Logistics Group in September 2021 and ICT Logistics in January 2022.

Total EBITDA before special items increased 88% to DKK 1,591m.

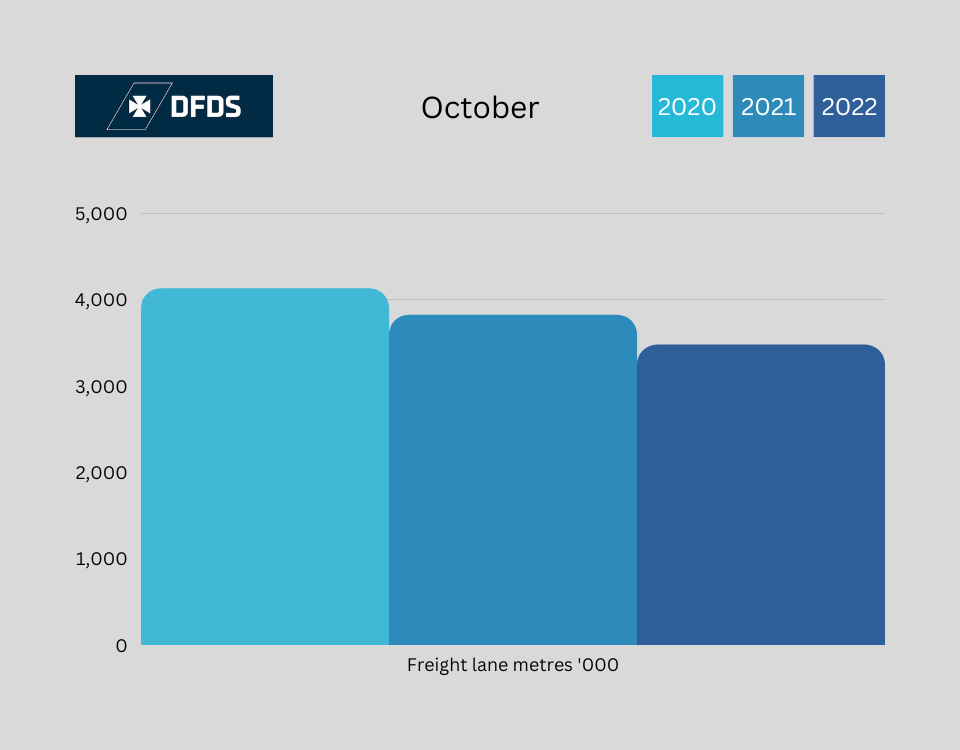

The EBITDA for freight ferry and logistics activities increased 28% to DKK 1,036m driven by higher earnings in all business units except for Channel.

Oil price increases were covered by the contractual pass-through clauses for ferry services.

Cost coverage for logistics services improved in Q3 on the back of initiatives taken in previous quarters.

The Q3 EBITDA for passenger activities in the Channel, Baltic Sea, and Passenger business units increased to DKK 569m from DKK 52m in 2021.

The continued recovery in passenger travel improved earnings in all three business units.

Outlook 2022

The outlook for EBITDA before special items is raised to DKK 4.8-5.0bn following a strong Q3 result and steady demand in both freight and passenger markets (previously DKK 4.4-4.8bn, 2021: DKK 3.4bn).

Revenue is expected to grow by around 45% compared to 2021 (previously around 40%). The outlook is detailed on page 10 in the full report.