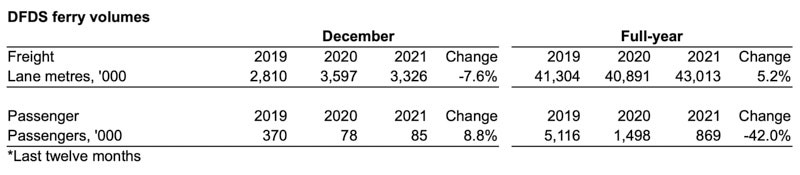

Freight:

- Total volumes in December 2021 were 7.6% below 2020.

- Net adjustments for structural route changes reduced growth 2.2 ppt to -9.8%.

- Total adjusted volumes were up 17.0% compared to December 2019.

- The decrease in total volumes compared to 2020 was entirely due to lower volumes on all UK routes as stock-building ahead of Brexit boosted volumes considerably on UK routes last year. Most of the UK routes are part of the North Sea and Channel business units which in December 2021 both were above 2019.

- The Mediterranean business unit continued to carry volumes above 2020 while Baltic Sea volumes were just below 2020 as capacity on one route was reduced from two ferries in 2020 to one ferry in December 2021.

- Volumes for both the Mediterranean and Baltic Sea business units were above 2019.

- For the full-year 2021, the total transported freight lane metres increased 5.2% to 43.0m from DKK 40.9m in 2020.

Passenger:

- The total number of passengers in December 2021 was 8.8% above 2020.

- The number of passengers increased between Norway and Denmark, while the number of passengers on UK routes decreased due to more severe travel restrictions on these routes.

- For the full-year 2021, the total number of passengers was 0.9m compared to 1.5m in 2020 and 5.1m in 2019, the latter being the latest pre-Covid-19 year.