H1, 2023 (January-June)

- Revenue EUR 336.4 (356.9 in 2022) million, -6%.

- Shipping and Sea Transport Services generated revenue amounting to EUR 325.3 (343.8) million, of which passenger-related revenue was to EUR 31.5 (25.6) million.

- The revenue of Port Operations was EUR 21.4 (24.8) million.

- EBITDA EUR 89.6 (97.7) million, -8%.

- Result for the reporting period EUR 41.9 (56.3) million, -26%.

- Interest bearing debt declined by EUR 69.1 million and was EUR 387.8 (456.9) million at the end of the period.

Q2, 2023 (April-June)

- Revenue EUR 173.2 (199.9 in 2022) million, -13%.

- EBITDA amounted to EUR 44.1 (62.1) million, -29%.

- Result for the reporting period EUR 20.3 (41.2) million, -51%.

Tom Pippingsköld, President and CEO, in conjunction with the review:

- Economic growth is projected to be modest in the EU area in 2023, but some moderate improvement is forecasted for 2024.

- According to the statistics of the Finnish Customs the total value of exports increased by 1%, but the value of imports decreased by 14.3% year-on-year (January–May 2023 vs. 2022).

- Due to the war and high interest rate environment consumer and business confidence has remained below long-term average. Inflation is also expected to remain persistently high.

- Lower import volumes have reduced cargo flows and together with lower bunker surcharge has affected Finnlines Group’s turnover.

- Lower volumes in some of our routes forced us to either reduce the frequency or the number of vessels in the route. Thus, we decided to charter out one ro-ro to the Grimaldi Group. Moreover, we have reduced capacity where there are lower volumes, and increased capacity where we see and have growth.

- Growth by opening new routes, the latest is the Sweden–Poland line where one ro-pax vessel is expected to start to operate daily between Malmö and Świnoujście in few weeks’ time.

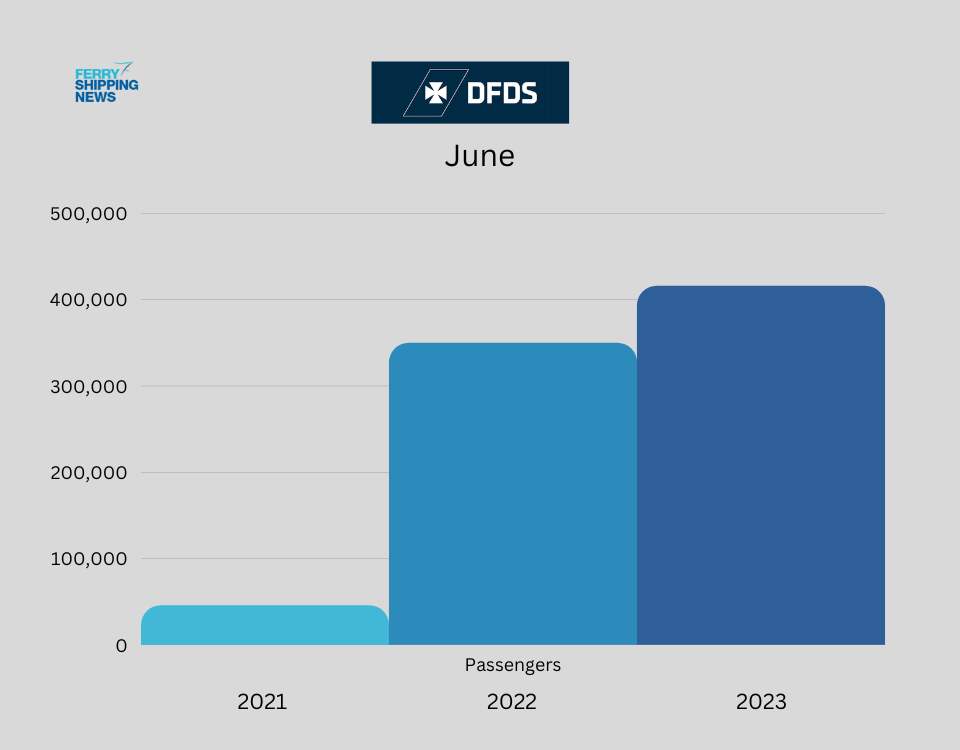

- Passenger business has increased very well after the pandemic.

- The first of these new Superstar ro-pax vessels, FINNSIRIUS, was delivered on 18 July 2023, as scheduled, and will enter the Naantali–Långnäs–Kapellskär route in mid-September.

- The second vessel, FINNCANOPUS, will follow by the end of the year.